ADIT vs. Other Tax Qualifications: Which One is Right for You?

Dec 28

/

Borys Ulanenko

Introduction

When it comes to advancing your career in taxation, choosing the right qualification is crucial. With so many options out there, it can be a tough decision. Two popular choices are the Advanced Diploma in International Taxation (ADIT) and other tax qualifications. In this blog post, we're going to explore the differences between ADIT and other tax qualifications, helping you decide which one aligns best with your career goals.

Understanding ADIT

ADIT, offered by the Chartered Institute of Taxation, is a globally recognized qualification focusing on international tax laws and practices. It's designed for professionals who want to gain an in-depth understanding of cross-border tax issues. The ADIT covers a wide range of topics, including principles of international taxation, jurisdiction-specific tax laws, and thematic modules like transfer pricing. What sets ADIT apart is its international perspective, offering insights into tax practices and systems across different countries.

Exploring Other Tax Qualifications

Other tax qualifications, such as the Certified Public Accountant (CPA) in the US, Chartered Accountant (CA) in various countries, or the Association of Taxation Technicians (ATT) qualification in the UK, have a more national focus. These qualifications are ideal for professionals looking to specialize in the tax laws of a specific country. They cover a broad range of subjects within taxation, including corporate tax, personal tax, and audit practices. Unlike ADIT, these qualifications are more suited to those who are looking to work within the tax systems of their respective countries.

Comparing ADIT with Other Qualifications

Focus and Scope:

ADIT is tailored for international tax, making it ideal for those working in, or aspiring to work in, international tax environments. In contrast, qualifications like CPA or CA focus more on the domestic aspects of taxation. If your career involves dealing with tax issues across borders, ADIT might be more beneficial.

Career Opportunities:

With ADIT, you can expect to find opportunities in multinational corporations, international tax consultancy, and law firms. It opens doors to a global career. On the other hand, qualifications like CPA or CA are highly valued in national markets and are essential for roles in local tax practices, government tax departments, and accounting firms.

Course Structure and Duration:

ADIT is a flexible qualification that can be completed alongside full-time work. The other tax qualifications often require more structured study and, in some cases, a longer commitment. Depending on your current work situation and study preferences, one may suit you better than the other.

Recognition and Accreditation:

ADIT is recognized internationally, which is a significant advantage if you're looking to work globally. National qualifications like CPA and CA are extremely well-recognized within their own countries but may not carry the same weight internationally.

ADIT is tailored for international tax, making it ideal for those working in, or aspiring to work in, international tax environments. In contrast, qualifications like CPA or CA focus more on the domestic aspects of taxation. If your career involves dealing with tax issues across borders, ADIT might be more beneficial.

Career Opportunities:

With ADIT, you can expect to find opportunities in multinational corporations, international tax consultancy, and law firms. It opens doors to a global career. On the other hand, qualifications like CPA or CA are highly valued in national markets and are essential for roles in local tax practices, government tax departments, and accounting firms.

Course Structure and Duration:

ADIT is a flexible qualification that can be completed alongside full-time work. The other tax qualifications often require more structured study and, in some cases, a longer commitment. Depending on your current work situation and study preferences, one may suit you better than the other.

Recognition and Accreditation:

ADIT is recognized internationally, which is a significant advantage if you're looking to work globally. National qualifications like CPA and CA are extremely well-recognized within their own countries but may not carry the same weight internationally.

Which to choose?

Choosing between ADIT and other tax qualifications depends largely on your career aspirations. If you're aiming for an international career dealing with complex cross-border tax issues, ADIT is an excellent choice. However, if your goal is to excel in the tax domain within your country, pursuing a national qualification like the CPA, CA, or ATT would be more appropriate.

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

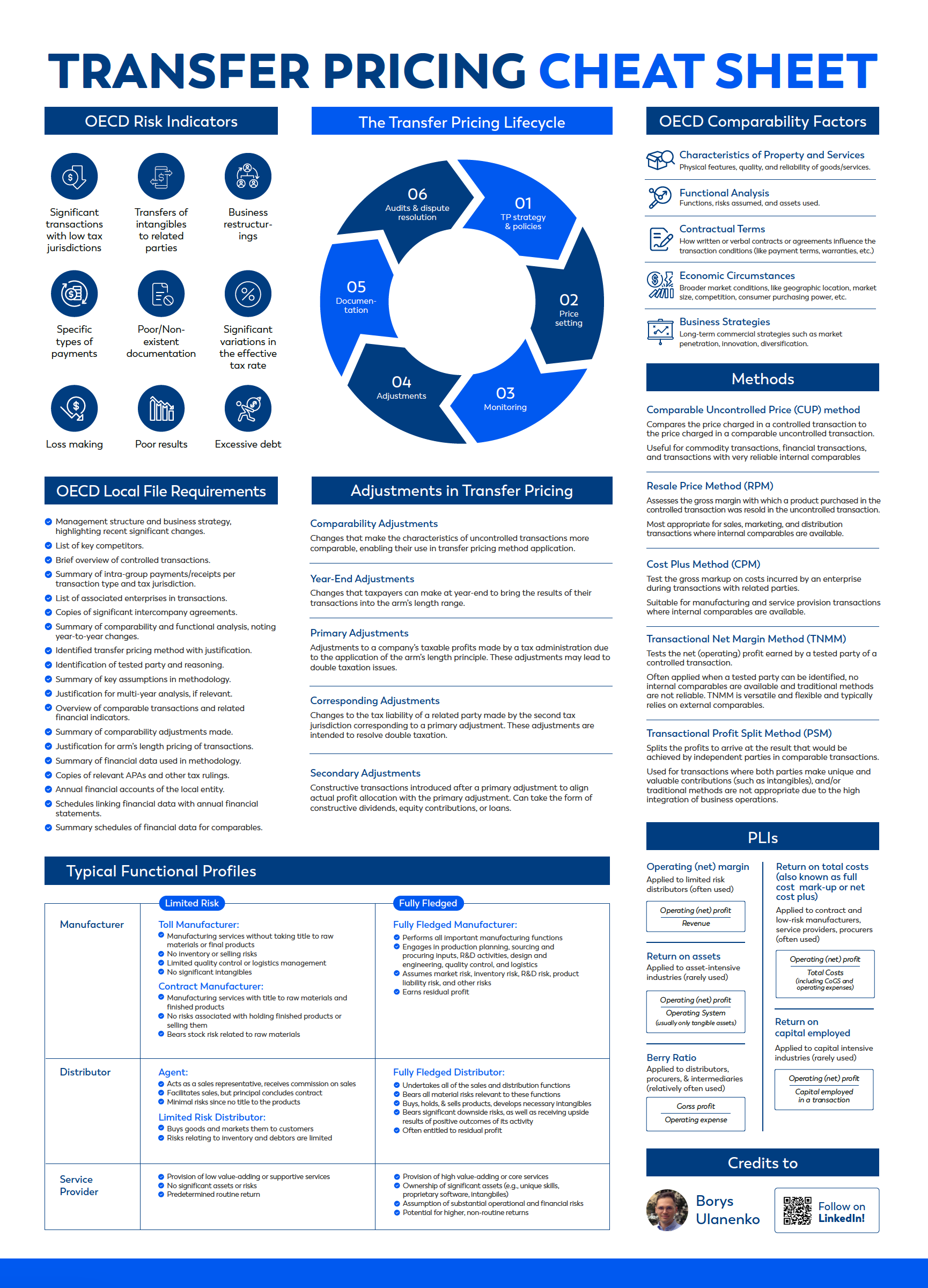

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.