Course

ADIT

Transfer Pricing Prep Course

The most comprehensive online self-paced transfer pricing course on the market. 98% pass rate since 2020.

Write your awesome label here.

ADIT exam pass guarantee

Pass ADIT TP exam or money back

Go through all the learning materials and complete assignments, and if you fail - get 100% refund.

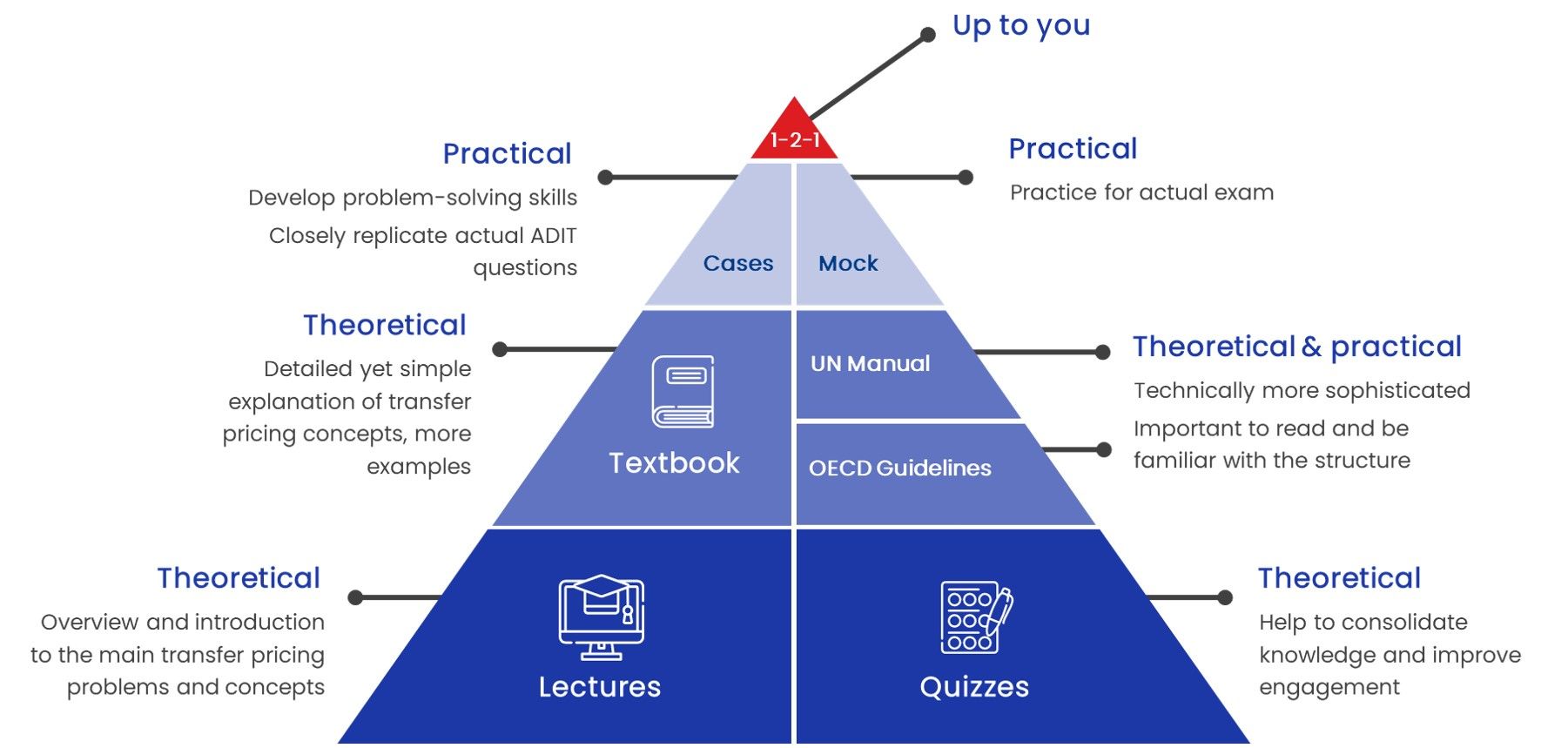

What's included?

-

18 hours of lectures

-

The textbook

-

Tests, quizzes, practical cases

-

Mock exam

-

2 hours of 1-2-1 learning sessions

Self-paced course

Self-paced learning allows you to work online and with physical materials on your terms, and in a way which suits your learning style. Get access to top-notch study materials!

One-stop-shop

This course covers all the facets you need to know to successfully pass the ADIT Transfer Pricing exam. Optimize your study time to achieve maximum results, boost your knowledge about transfer pricing and solve any transfer pricing issue yourself!

Meet the Author

Hi! This is me.

My name is Borys Ulanenko. Like many of you, I understand the daunting challenge of the ADIT exam. With over a decade of experience in transfer pricing, including senior roles at KPMG and Royal Dutch Shell, I thought I was ready. But in 2018, when I decided to earn my ADIT certification, I faced unexpected hurdles: a complex syllabus, ambiguous requirements, and expensive resources. It was overwhelming, but it was also a turning point.

After successfully obtaining my certification, I created a unique ADIT preparation method that guarantees successful exam passing (if you are ready to put in hard work, of course!).

After successfully obtaining my certification, I created a unique ADIT preparation method that guarantees successful exam passing (if you are ready to put in hard work, of course!).

This method isn't just theoretical; it's a tested pathway to passing the ADIT transfer pricing exam on your first attempt. If you want stress-free, structured, guided preparation and you are serious about passing the exam - look no further!

Borys Ulanenko - Course author

Structure of the course & materials

Course contents

Latest from our blog

Please share your feedback!

Thank you!

Frequently asked questions

1. Should

I buy the textbook separately If I join the course?

The textbook is included in the course package, and we will send it to you as soon as you register for the course. You do not have to buy the book separately.

2. Will I get an e-copy of the textbook?

Yes, you will get an e-copy after buying the course.

3. How long will I have access to the course?

You will have access for nine months. However, we can provide you with additional 3 months of access for free (on request).

4. How soon will I receive personalized feedback about my case solutions / the mock exam?

We will provide you with detailed personalized feedback within 48 hours.