Ultimate Transfer Pricing Career Guide (2024)

Jan 15

/

Borys Ulanenko

Contents

When I joined the international tax world in 2012, I was shocked by how little there was out there about a career in transfer pricing. This must have been because it was so new and niche at the same time, and the profession was unfamiliar to many. Not so today.

Since 2012, I went from intern to senior manager and then senior advisor positions, worked for Big4 and two multinationals, and I thought its a good time to share my knowledge, experiences and thoughts with the community. Feel free to skip some sections if they are not relevant for you!

Since 2012, I went from intern to senior manager and then senior advisor positions, worked for Big4 and two multinationals, and I thought its a good time to share my knowledge, experiences and thoughts with the community. Feel free to skip some sections if they are not relevant for you!

1. But first things first - what is transfer pricing?

Transfer pricing (or just TP) is the process of setting the price for goods and services in cross-border transactions between related entities (subsidiaries or affiliates). For example, let's take Tesla and assume it manufactures batteries in Germany, assembles cars in the US and sells them in Norway. In this case, Tesla Germany would have to sell batteries to Tesla US, and Tesla US would assemble cars using this component and sell them to Tesla Norway. According to international and domestic tax law, Tesla would have to ensure that each transaction (transfer) is priced fairly - because transfer pricing is effectively the process of deciding where to put profits and losses in an international business.

This should give you a flavour of what transfer pricing experts do - they help set the prices and, later on, document and defend them in front of tax authorities. So, effectively, transfer pricing is a part of the international tax discipline.

This should give you a flavour of what transfer pricing experts do - they help set the prices and, later on, document and defend them in front of tax authorities. So, effectively, transfer pricing is a part of the international tax discipline.

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Quick Reference: Key Transfer Pricing Principles Summarized

Have all core TP concepts at your FINGERTIPS

Get your free TP cheat sheet!

Thank you! Download here.

2. Transfer pricing lifecycle - what do TP specialists really do?

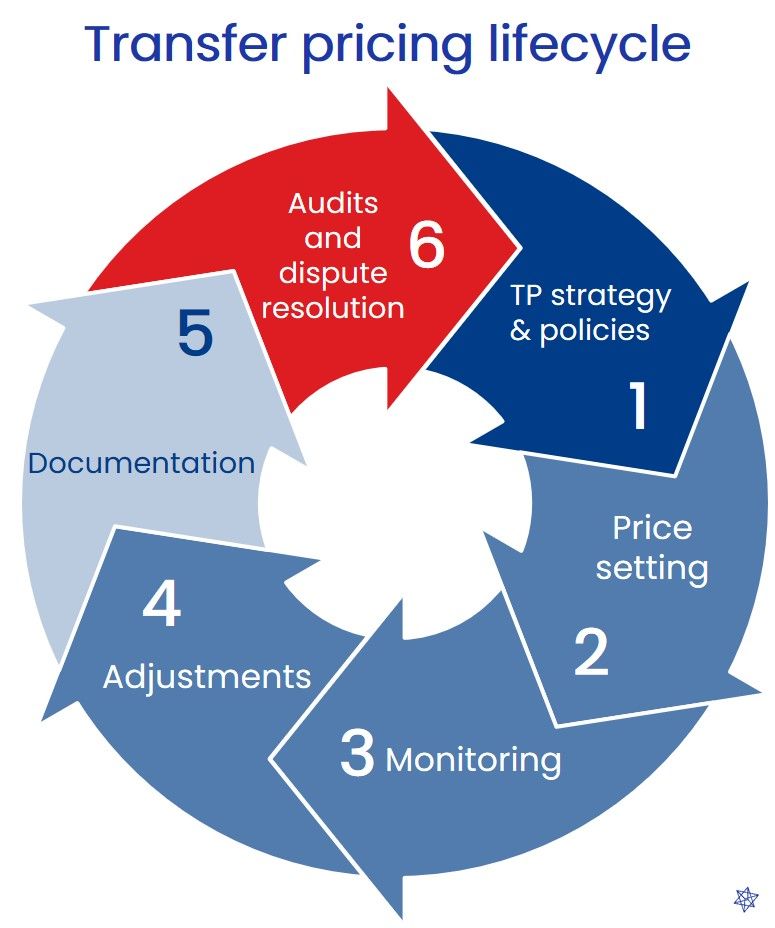

Here is a bird-eye view of what transfer pricing involves. Sometimes, we call it a "transfer pricing lifecycle". It will help you understand the work of a transfer pricing expert end-to-end.

1) Establishing transfer pricing strategy and policies. At this stage, the company decides a general approach to transfer pricing, including how much risk the company wants to take and what type of models it will apply, and TP experts usually drive these discussions.

2) At the next stage, the company establishes price-setting process - this means determining and applying transfer prices in actual transactions. TP specialists would usually be responsible for suggesting the correct price or margin for the transaction. And obviously, there is a lot of work to be done to arrive at this price.

3) Then, there is a monitoring process - does the business follow the transfer pricing policies, and are the prices within the determined ranges? The role of TP experts here can vary significantly - in some companies, they are responsible and accountable for it; in others, it's mainly a finance team job (and TP specialists just provide the advice).

4) The next one - adjustments. Due to business circumstances, the company often realizes that some of the prices are falling from the arm's length market ranges and needs to adjust them at the end of the year (or, sometimes, during the year). TP specialists usually help finance to decide if the adjustment is needed and what would be its size.

2) At the next stage, the company establishes price-setting process - this means determining and applying transfer prices in actual transactions. TP specialists would usually be responsible for suggesting the correct price or margin for the transaction. And obviously, there is a lot of work to be done to arrive at this price.

3) Then, there is a monitoring process - does the business follow the transfer pricing policies, and are the prices within the determined ranges? The role of TP experts here can vary significantly - in some companies, they are responsible and accountable for it; in others, it's mainly a finance team job (and TP specialists just provide the advice).

4) The next one - adjustments. Due to business circumstances, the company often realizes that some of the prices are falling from the arm's length market ranges and needs to adjust them at the end of the year (or, sometimes, during the year). TP specialists usually help finance to decide if the adjustment is needed and what would be its size.

5) Then, there is the documentation and compliance process. The company has to prepare, maintain, and submit transfer pricing compliance documentation. Often, people think that this is the only work TP specialists do, but (as I explained earlier), that's not the case anymore. However, it is still a significant part of TP work.

6) The last step is audits and dispute resolution. No matter how good the process and documentation are, tax authorities still can and probably would try to challenge them. TP experts usually work closely with lawyers and litigation specialists, providing technical TP support.

6) The last step is audits and dispute resolution. No matter how good the process and documentation are, tax authorities still can and probably would try to challenge them. TP experts usually work closely with lawyers and litigation specialists, providing technical TP support.

3. What are the seniority levels in the profession, and what do TP specialists do at each of them?

The answer to this question really depends on the organization you work for (I will discuss them later on), but let me try to explain in general terms.

- Interns/junior consultants/junior specialists - the entry-level. This is the lowest position level where TP specialists work at the start of their careers. They typically help the team with the basic work and learn the ropes. Interns and juniors usually do benchmarking studies, draft basic documentation, and do some simple financial and market analysis.

- Senior consultants/senior specialists - the workhorses of transfer pricing. They will usually do a more advanced TP analysis and reports. In addition, they prepare the draft documentation and memos for the manager's review and train their junior level colleagues.

- Managers and advisors (in-house) - usually the leads of TP projects. The manager checks the TP specialist's work, makes suggestions and approves it for further use. In Big4, managers talk with clients and usually run functional interviews. You need to be ready that there would be much more people management and client work at this level. At the same time, the in-house TP advisor role would often be mainly focused on technical TP work.

- Directors, partners, EVPs - the senior leaders of the transfer pricing team. They do a lot more client work and participate in high-level discussions in the most complex and problematic projects. They are the most experienced people in the team, and managers would often reach out to them if the transfer pricing problem is controversial.

4. Where do TP experts work?

Various organizations hire TP people (or grow them). I've listed them in the order of decreasing frequency:

1) Big 4 firms plus other large international networks (like Grant Thornton, BDO, Baker Tilly, etc.) - this is where I started my career. Big4 have large transfer pricing teams in most developed countries (UK, USA, Canada, Australia, Germany) and are constantly expanding. Most of the roles descriptions I've put above are relevant here, as most TP experts around the world work in these companies. That's the best place to start your TP career, in my opinion. Big4 offer great opportunities for fast career progression, and after a few years, you'll be very experienced in TP because you'll be exposed to a large number of clients, business models, industries, TP cases and problems, and will usually have a lot of great colleagues to learn from. The downside of a TP consulting career is work-life balance - you may be overwhelmed by the workload and responsibility. In addition, consultants are often underpaid compared to their in-house peers (discussed below).

1) Big 4 firms plus other large international networks (like Grant Thornton, BDO, Baker Tilly, etc.) - this is where I started my career. Big4 have large transfer pricing teams in most developed countries (UK, USA, Canada, Australia, Germany) and are constantly expanding. Most of the roles descriptions I've put above are relevant here, as most TP experts around the world work in these companies. That's the best place to start your TP career, in my opinion. Big4 offer great opportunities for fast career progression, and after a few years, you'll be very experienced in TP because you'll be exposed to a large number of clients, business models, industries, TP cases and problems, and will usually have a lot of great colleagues to learn from. The downside of a TP consulting career is work-life balance - you may be overwhelmed by the workload and responsibility. In addition, consultants are often underpaid compared to their in-house peers (discussed below).

2) Large multinationals - these are global companies with many international operations. While most corporations outsource their TP to external consultants, many of them (like Nestle, Coca-Cola, Unilever, Shell, etc.) have internal TP teams, and they can be very attractive options for TP professionals. There is a significant variation in what these TP teams do, from strategic TP work (like developing transfer pricing policies for the company) to tactical TP processes (like doing price analysis for every transaction). You'll spend much less time on client-related tasks and more time on pure TP. These teams usually prefer hiring experienced professionals and rarely offer entry-level TP jobs (though some of them do). The benefits of in-house roles are that they are usually better paid, the work-life balance is much better, often with more autonomy, and less politics (sometimes). You also can develop great industry specialization, and your CV becomes more attractive for other MNEs in the same area. The downsides are that they can be conservative organizations and have more robust hierarchies (which doesn't work for everyone). Also, your TP professional development pace can be much slower, as you would have a more stable and repetitive scope. To summarize - the in-house roles are more stable and less stressful, but they offer slower progression, and you won't have any external client and business development work.

3) Governmental institutions - most countries have governmental transfer pricing offices, usually a part of the tax authority. Tax offices in many countries have positions for transfer pricing experts, especially in audit units and advance pricing agreement departments. There, you'll have a chance to meet with taxpayers (and tax authorities of other countries) to agree on their future transfer pricing. Generally, the work itself is somewhat similar to that in Big4, but it's less modern, and the pay is lower (work-life balance varies, but it is generally better). At the same time, you'll need to spend more time on bureaucracy, and the pace of work is somewhat slower. In the past, tax authorities tend to rely on internal recruitment for their TP roles; however, we see more and more external openings nowadays. The market highly values this work experience, and it's not rare to see ex-tax officers moving to senior Big4 or in-house positions.

4) Other, more rare opportunities:

- Law firms - often focus on contracting and litigation sides of transfer pricing.

- Boutique firms - I'd say the work there is quite similar to Big4 and other consulting; however, they usually hire experienced professionals and work on the most complex TP projects. Definitely, an exciting place to work.

- OECD, think tanks, international organizations - someone has to write the OECD Guidelines, develop and assess TP policies, train tax authorities of developing countries, right? That's what TP experts do in these organizations. In the TP world, this is a very unique and prestigious job. So they usually hire very experienced TP people or find someone from another policy field.

- Technology firms - in the last years, I've seen a significant number of technology firms and start-ups working on TP automation solutions (and they need TP experts). If you are interested in technology and TP simultaneously, that's a great option to consider.

- Law firms - often focus on contracting and litigation sides of transfer pricing.

- Boutique firms - I'd say the work there is quite similar to Big4 and other consulting; however, they usually hire experienced professionals and work on the most complex TP projects. Definitely, an exciting place to work.

- OECD, think tanks, international organizations - someone has to write the OECD Guidelines, develop and assess TP policies, train tax authorities of developing countries, right? That's what TP experts do in these organizations. In the TP world, this is a very unique and prestigious job. So they usually hire very experienced TP people or find someone from another policy field.

- Technology firms - in the last years, I've seen a significant number of technology firms and start-ups working on TP automation solutions (and they need TP experts). If you are interested in technology and TP simultaneously, that's a great option to consider.

5. Skills and knowledge for transfer pricing career

Here, I've tried to list the most valuable skills for a transfer pricing career. The list is by no means comprehensive, but in my hiring manager experience, people with these skills tend to be the most successful candidates. Some of them are easier to test during the recruitment process, while others would be more important for career development once you are in. Also, here I was primarily focusing on the technical skills - I'll share my view about soft skills relevant for TP at the end of this list. And just to be clear - it's an entry-level list.

International Tax Law

Level: basic - you need to know the OECD Model Tax Convention, what the "BEPS" means, and how different countries' tax authorities agree if they have conflicting views (hint - MAP).

How to study: I strongly recommend Coursera's "Rethinking International Tax Law" course by Prof. Dr Sjoerd Douma. The level of detail is perfect for someone just starting the TP career, and it is also very interesting!

If you want something more advanced: I love the "Principles of International Taxation" book by Lynne Oats, Angharad Miller, Emer Mulligan. It introduces essential international tax concepts and is very engaging. A lot of valuable insights - after reading it, you'll know international tax!

Financial Accounting

Level: basic - your goal here is to understand the P&L and balance sheet, how they relate to each other, and how accounting works.

How to study: the ideal level for a future TP expert is equivalent to the ACCA F3 exam (now they call it FA!). I don't have a preferred course or book here - you'll find plenty of materials on Google, both free and paid.

Economics

Level: basic - you want to focus on entry-level micro- and macroeconomics (including international trade). You need to understand concepts of firm behaviour, profit maximization, interest rates, inflation, etc.

How to study: there are a lot of entry-level economics courses that are perfect for someone just starting their TP career. I enjoyed Coursera's "Microeconomics Principles" by Dr José J. Vázquez-Cognet

and the new Udemy macro course by Brad Cartwright.

Transfer pricing

Level: basic/intermediate - even though many entry-level TP jobs don't require you to know TP, it would be a great advantage if you know at least some of it. You'll definitely differentiate yourself from the crowd.

How to study: the problem with TP is that it is a very specialized field, and there is not many good free materials and courses available. However, you can check this post for an overview of the resources. I also have the Udemy course on Transfer Pricing Fundamentals, and if you want it for free, you can reach out to me on LinkedIn or via email, and I'll send you a coupon.

If you want something more advanced: check the ADIT section below.

If you want something more advanced: check the ADIT section below.

Digital literacy

Level: basic/intermediate - I think it's expected now from everyone - you need to work with basic computer applications like emails, MS Teams/Zoom, files and folders, browsers, etc. Basic MS Word and SharePoint skills also go here.

How to study: I was never searching for anything like that, but I quickly found a good course on LinkedIn Learning. However, there are many other options, so feel free to find the one you'd like.

How to study: I was never searching for anything like that, but I quickly found a good course on LinkedIn Learning. However, there are many other options, so feel free to find the one you'd like.

Excel

Level: Intermediate - in your TP work, you'd probably work quite a lot with data and tables, and it's very useful to have good Excel skills. You need to be able to use all of the essential formulas (including the famous VLOOKUP!). What's more important - you need to understand the problems you can solve with Excel, be able to Google relevant formulas quickly, and semi-automate mundane tasks.

How to study: Excel is a backbone of the modern corporate world, and there are plenty of good courses around. But if you take this Coursera course, I'm pretty sure I'd know Excel better than 90% of TP people.

PowerPoint

Level: Intermediate - you'll need to do some presentations and reports in your work, and PowerPoint slides are still the primary communication instrument in the TP world.

How to study: check out this Coursera course by PwC.

How to study: check out this Coursera course by PwC.

Modern tech skills

Level: Optional - TP is quite a conservative field, and in many organizations, the work is done in a way it was done 10 or even 15 years ago. However, I clearly see a growing demand for digitalization and automation. If you have technical skills that would help your company in this journey, this can differentiate you from other candidates. Just to be clear - I don't think you have to have the 100% ability to deliver the automation solution - it's more about the understanding of possibilities and available options.

How to study: I'd say knowing advanced Excel, basic Python and/or MS Visual Basic, Power BI would make you stand out and help in your career in the 2020s. There are plenty of free courses - just choose one area and pick the intro course.

How to study: I'd say knowing advanced Excel, basic Python and/or MS Visual Basic, Power BI would make you stand out and help in your career in the 2020s. There are plenty of free courses - just choose one area and pick the intro course.

Using ChatGPT (2024 Update)

Level: Optional but will become crucial soon.

You should absolutely use ChatGPT to prepare yourself for transfer pricing career. It's very knowledgable and often performs on par with tax advisors. What's more, it can prepare you for a recruitment interview, identify your gaps and substantially increase chances of success.

You should absolutely use ChatGPT to prepare yourself for transfer pricing career. It's very knowledgable and often performs on par with tax advisors. What's more, it can prepare you for a recruitment interview, identify your gaps and substantially increase chances of success.

As of 2024, the integration of AI tools like ChatGPT has revolutionized how TP professionals approach their work.

Here's how you can leverage ChatGPT to enhance various aspects of your TP work:

Client Work:

Documentation:

Brainstorming:

Here's how you can leverage ChatGPT to enhance various aspects of your TP work:

Client Work:

- Writing Emails and Proposals: ChatGPT can help draft professional and articulate emails or proposals, saving you time while ensuring high-quality communication.

- Information Requests: Use ChatGPT to formulate clear and concise information requests, essential for effective client communication.

Documentation:

- Functional Analysis: ChatGPT assists in the initial drafting of functional analysis documents, providing a structured and coherent base to work from.

- Industry Overview: Leverage AI to quickly gather and summarize industry-specific data, offering a comprehensive overview for your TP documentation.

Brainstorming:

- TP Risks and Strategies: ChatGPT acts as a brainstorming partner, helping you explore various TP risks and strategies. It's like having an on-demand colleague for bouncing ideas off.

What about soft skills?

I don't think that soft skills for TP are substantially different from any other finance or analytics job. The essence of the work (especially in the first two or three years) is all about gathering information, doing good analysis, writing memos, documentation and preparing PowerPoints. I'd say that good English, and especially writing and presentation skills are the main things you want to focus on. Attention to detail, good analytical skills and time management are also critical in the TP profession.

6. Are there any professional certifications in transfer pricing?

As of 2022, there is only one qualification that is recognized by most of the TP industry worldwide - the Advanced Diploma in International Taxation (ADIT).

The Chartered Institute of Taxation (CIOT), in the UK, offers a professional qualification and credential called ADIT to international tax professionals. From my experience, in the US, UK and Europe, the CIOT ADIT qualification is accepted by everyone (tax and advisory firms, Big Four firms and governments), so it's a very competitive edge to have it. In addition, if you are ADIT, your future employer would automatically assume that you know TP and international tax well enough to do most of the work.

To acquire the full ADIT qualification, you need to take three exams (the Principles of International Taxation exam and two jurisdictional or thematic exams). You can check the list of the exams in the syllabus. (I must say I don't really like the CIOT new website as some of the links don't work and it's sometimes counter-intuitive, so if you have questions don't hesitate to reach out to them or to me directly).

In 2020, I created the online transfer pricing course for the ADIT exam preparation and wrote the textbook to help with the preparation. Remember that there is an option to get a standalone TP certificate after passing the ADIT TP exam - so if you don't want to do all three exams, one can be sufficient.

The Chartered Institute of Taxation (CIOT), in the UK, offers a professional qualification and credential called ADIT to international tax professionals. From my experience, in the US, UK and Europe, the CIOT ADIT qualification is accepted by everyone (tax and advisory firms, Big Four firms and governments), so it's a very competitive edge to have it. In addition, if you are ADIT, your future employer would automatically assume that you know TP and international tax well enough to do most of the work.

To acquire the full ADIT qualification, you need to take three exams (the Principles of International Taxation exam and two jurisdictional or thematic exams). You can check the list of the exams in the syllabus. (I must say I don't really like the CIOT new website as some of the links don't work and it's sometimes counter-intuitive, so if you have questions don't hesitate to reach out to them or to me directly).

In 2020, I created the online transfer pricing course for the ADIT exam preparation and wrote the textbook to help with the preparation. Remember that there is an option to get a standalone TP certificate after passing the ADIT TP exam - so if you don't want to do all three exams, one can be sufficient.

Also, if you are going to focus on managerial, financial and organizational aspects of TP, you may consider taking the CIMA qualification - even though it's not about TP, it gives a lot of helpful knowledge and skills for the profession. I observed my CIMA-qualified colleagues, and I was impressed!

7. Is transfer pricing a good career option?

It really depends on what you want in your life and career. Here are a few facts that you need to consider:

The good thing about transfer pricing is that there are different career paths. Many organizations hire TP experts, and each of them offers different opportunities. For example, if you like cooperating with people and want to work in an environment oriented towards teamwork, dynamic and challenging, I'd say consulting firms are a good choice. On the other hand, if you are looking for more stable and exciting analytical work that is well-paid, you can consider in-house roles.

What do I love about TP? Well, the most exciting thing for me is that TP is still a pretty closed and conservative world, but at the same time, you can bring a lot of innovation from other fields there. For example, if you know how to automate things, you'll find many opportunities in TP - it's still very "manual". If you can write well, or you generally like creating content, you'll be surprised how few good TP blogs and vlogs are out there. TP offers great opportunities for people with different skill sets. Another great thing about TP is that you really need to understand how businesses work to do your job.

I love the professional and intellectual aspects of the job, and I can't say that it's a boring or dull environment. The job is not too challenging if you know what you're doing, but if you have some questions or challenges, there are always people around to help.

Generalists vs specialists. Once you know what you want, there are still two paths to take. Many people who work in TP are generalists, which means they can do a bit of everything. They would usually know all of the TP lifecycle I discussed above, and they would know how to deal with various types of transactions and business models. On the other hand, some people choose a specialization - they focus on one or two areas, such as financial transactions. For example, Big4's Luxembourg and London offices are known for their outstanding financial TP expertise. It's up to you to decide what you want - generalists are very flexible and deal with various situations very well, but specialists get deep knowledge in a specific area and can truly be experts in the field. I've decided to be a generalist, and you can read this article to understand why.

- TP is niche - first of all, it's a unique global profession, and not many people are interested in it. As a result, there is a high demand for professionals, salaries are high, but the positions are usually relatively clustered. For example, in many countries, TP jobs are concentrated in the capital and a couple of the largest cities, and the primary employers are Big4 companies. Also, it's often not that easy to move out from TP without losing in salary. Finally, the more you work in TP, the more difficult it is to change the profession (similar to other niche jobs).

- TP is an international profession - there are (almost) no borders in the TP world because most of the rules and principles are similar. So if you want to change the country at some point in your career, TP can be a good choice.

- TP is growing - the number of TP jobs grows every year, and the market is far from fully saturated. Even though there are discussions about the adequacy of the arm's length principle, I don't think it will be replaced anytime soon, so TP is a relatively safe choice.

- TP is based on the fundamental principles - the good news is that some of the basic concepts are pretty simple and are not changing much (like the main transfer pricing principle - "the arm's length principle"), so if you know them well, you can grasp new things very quickly.

- TP is dynamic - TP laws and regulations change very often, and you need to keep up with them. Tax and transfer pricing are very special fields, and the job requires a constant focus to always know about the latest developments in your area of expertise.

- Noone will understand what you are doing (including your mom) - it's pretty difficult to explain to the outsider what your job is about and what you do daily.

- TP is all about explaining complex things in simple words - you'll often find yourself explaining complicated tax and TP-related problems to your client or business partners in a very understandable way. That's what you need to be able to do (and love as well) - educate others.

The good thing about transfer pricing is that there are different career paths. Many organizations hire TP experts, and each of them offers different opportunities. For example, if you like cooperating with people and want to work in an environment oriented towards teamwork, dynamic and challenging, I'd say consulting firms are a good choice. On the other hand, if you are looking for more stable and exciting analytical work that is well-paid, you can consider in-house roles.

What do I love about TP? Well, the most exciting thing for me is that TP is still a pretty closed and conservative world, but at the same time, you can bring a lot of innovation from other fields there. For example, if you know how to automate things, you'll find many opportunities in TP - it's still very "manual". If you can write well, or you generally like creating content, you'll be surprised how few good TP blogs and vlogs are out there. TP offers great opportunities for people with different skill sets. Another great thing about TP is that you really need to understand how businesses work to do your job.

I love the professional and intellectual aspects of the job, and I can't say that it's a boring or dull environment. The job is not too challenging if you know what you're doing, but if you have some questions or challenges, there are always people around to help.

Generalists vs specialists. Once you know what you want, there are still two paths to take. Many people who work in TP are generalists, which means they can do a bit of everything. They would usually know all of the TP lifecycle I discussed above, and they would know how to deal with various types of transactions and business models. On the other hand, some people choose a specialization - they focus on one or two areas, such as financial transactions. For example, Big4's Luxembourg and London offices are known for their outstanding financial TP expertise. It's up to you to decide what you want - generalists are very flexible and deal with various situations very well, but specialists get deep knowledge in a specific area and can truly be experts in the field. I've decided to be a generalist, and you can read this article to understand why.

8. I am in the US - is what you've written here relevant for me?

The short answer is Yes. Transfer pricing is an international profession, and everything I described here applies to the US transfer pricing market. Here are a couple of nuances for you to know:

I hope you found this guide useful, and if you have any questions or comments, feel free to contact me anytime. I am also looking forward to opinions from other TP practitioners - this is a very subjective guide, and I know my peers can add unique insights and perspectives!

(I also want to make a special reference to professor Lorraine Eden, who lectured on transfer pricing between 1995 and 2019 in the US (Texas A&M). She is a great TP thought leader and she wrote a comprehensive TP career advice article in 2011 which is available under this link. Most of the points raised by Lorraine in this article are still relevant today.)

- The USA, being the largest economy in the world, has the biggest market for transfer pricing services. You're in a favorable position if you're based there.

- The USA has the oldest transfer pricing regulations and the most developed practices in this field.

- US transfer pricing regulations generally align with the OECD framework, but there are some differences. For example, some methods have different names, and their application can vary slightly. However, the overall approach is still very similar.

I hope you found this guide useful, and if you have any questions or comments, feel free to contact me anytime. I am also looking forward to opinions from other TP practitioners - this is a very subjective guide, and I know my peers can add unique insights and perspectives!

(I also want to make a special reference to professor Lorraine Eden, who lectured on transfer pricing between 1995 and 2019 in the US (Texas A&M). She is a great TP thought leader and she wrote a comprehensive TP career advice article in 2011 which is available under this link. Most of the points raised by Lorraine in this article are still relevant today.)

9. I am in India - is what you've written here relevant for me?

Absolutely, yes. Transfer pricing is a global discipline, and much of what I have discussed is applicable to the Indian transfer pricing landscape as well. However, there are some unique aspects of the Indian market that you should be aware of:

I hope you found this guide useful, and if you have any questions or comments, feel free to contact me anytime. I am also looking forward to opinions from other TP practitioners - this is a very subjective guide, and I know my peers can add unique insights and perspectives!

(I also want to make a special reference to professor Lorraine Eden, who lectured on transfer pricing between 1995 and 2019 in the US (Texas A&M). She is a great TP thought leader and she wrote a comprehensive TP career advice article in 2011 which is available under this link. Most of the points raised by Lorraine in this article are still relevant today.)

- India is one of the fastest-growing economies in the world and has a rapidly evolving transfer pricing market. This presents a dynamic and challenging environment for professionals in the field.

- Indian transfer pricing regulations are relatively young compared to those in the US and few other developed countries. They are constantly evolving, reflecting the country's developing economic landscape.

- While Indian regulations are influenced by the OECD guidelines, they have distinct features, including specific rules on documentation and benchmarking analyses.

- The Indian tax authorities have a reputation for being quite stringent and proactive in transfer pricing audits.

I hope you found this guide useful, and if you have any questions or comments, feel free to contact me anytime. I am also looking forward to opinions from other TP practitioners - this is a very subjective guide, and I know my peers can add unique insights and perspectives!

(I also want to make a special reference to professor Lorraine Eden, who lectured on transfer pricing between 1995 and 2019 in the US (Texas A&M). She is a great TP thought leader and she wrote a comprehensive TP career advice article in 2011 which is available under this link. Most of the points raised by Lorraine in this article are still relevant today.)

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.