What is Transfer Pricing?

1. What Is Transfer Pricing?

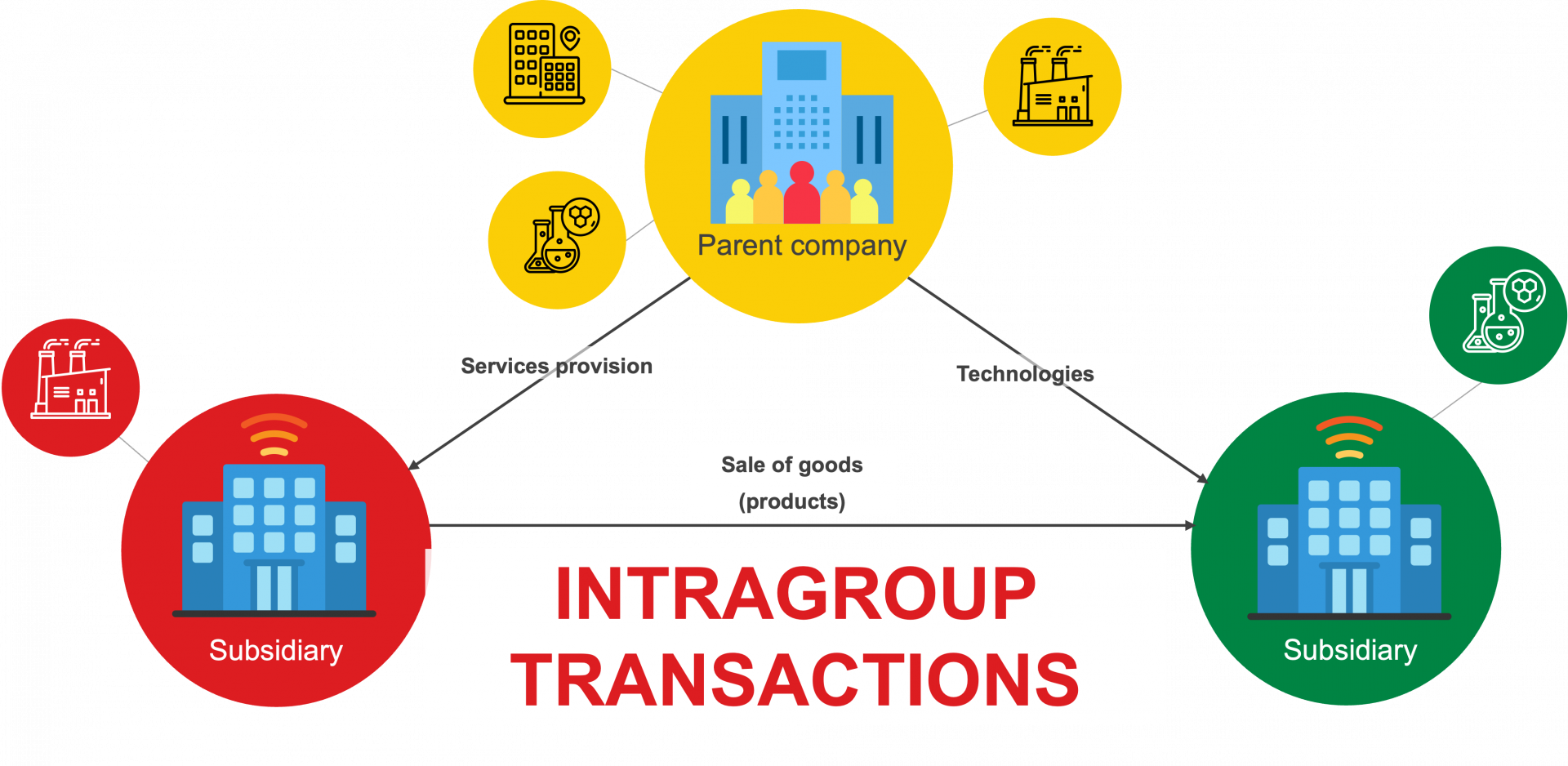

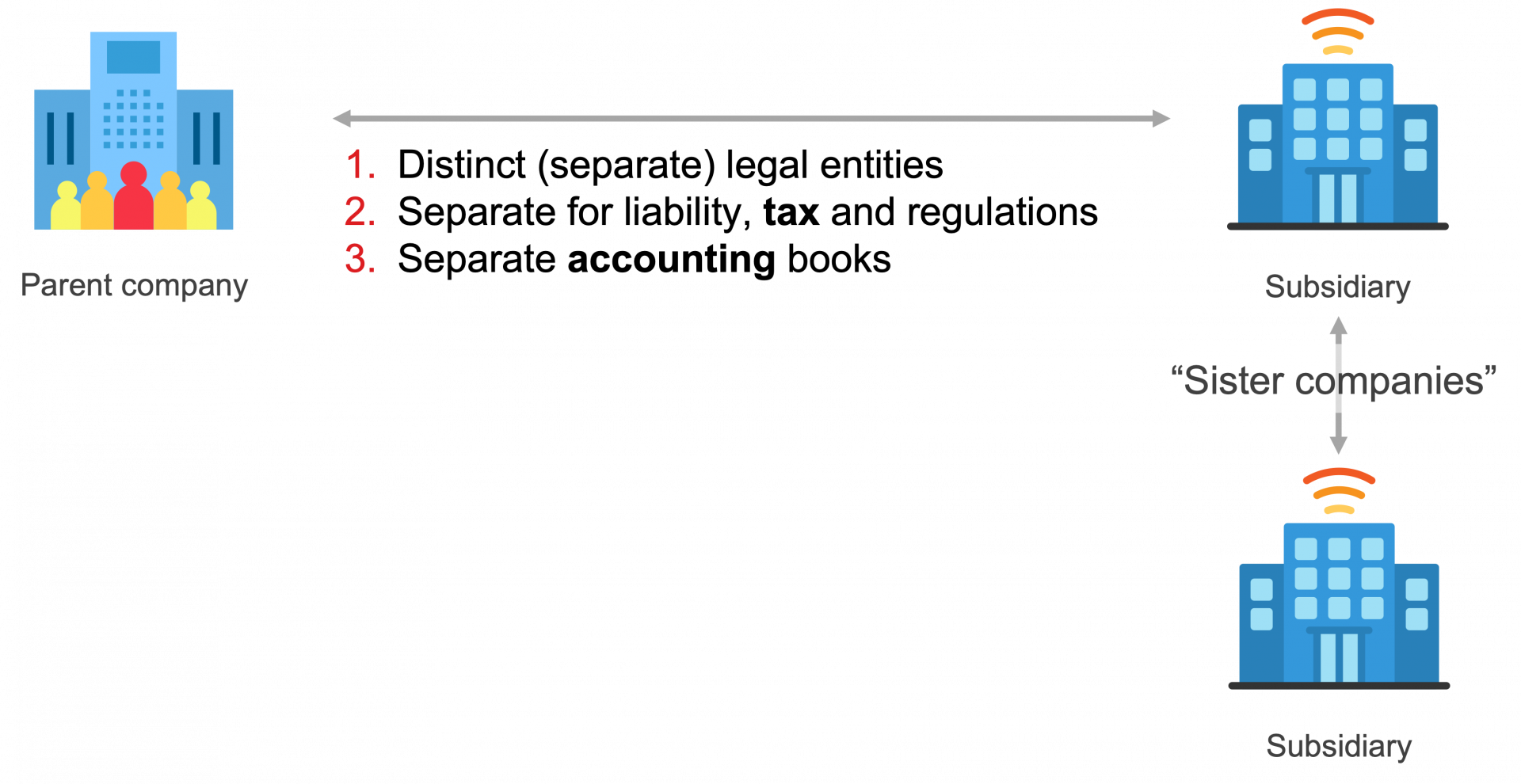

Transfer pricing is a bit like a family business where members sell products or services to each other. Imagine a family that owns several bakeries across different countries. If one bakery in Italy sells flour to another in France, they need to decide on a price. This internal pricing is what we call transfer pricing.

In the corporate world, transfer pricing occurs when different divisions of a multinational company, often located in different countries, trade with each other. Think of a tech giant in the U.S. selling software to its subsidiary in Ireland. The price set for this software is crucial. It's like setting the right temperature in a greenhouse; it needs to be optimal for growth without upsetting the balance.

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Get your free TP cheat sheet!

2. Why Is Transfer Price Used?

1. To allocate taxable profits and losses among the members of a group of companies and to have these profits and losses taxed in the jurisdictions where they are generated.

2. To create profit centres that can be used to set up and incentivize internal transfers of valuable property, services, and capital in the group.

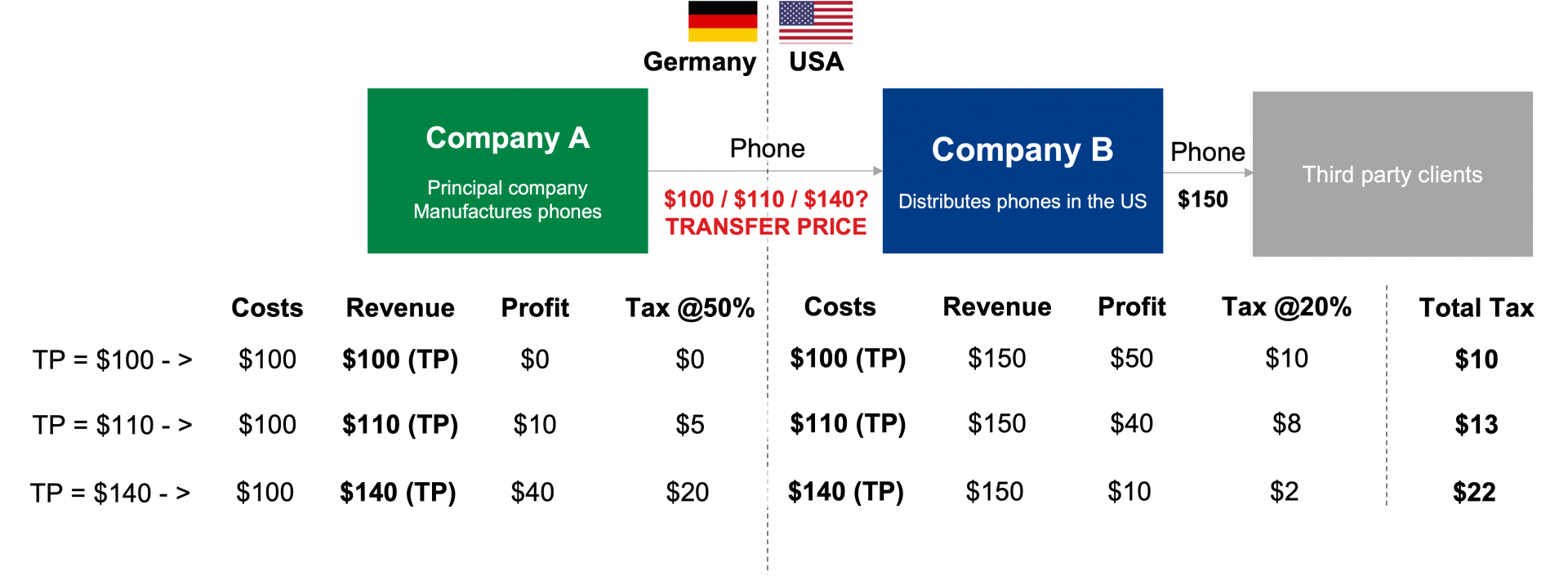

You may now ask, "who cares what price they use?". Taxation is the answer.

At the same time, transfer pricing is used by corporations to incentivize their management and have a proper set of KPIs so that every manager looks after the P&L of her subsidiary. So, for example, a manager of Company B who sells phones at $140 would have a higher P&L than her peer who sells them at $100. And this is the way that the company achieves "performance-based" rewards through transfer pricing. Hence, it is called "managerial transfer pricing". However, tax transfer pricing is usually much more important in the modern world, as companies may have separate KPI scorecards to assess the performance of their subsidiaries.

When is transfer pricing relevant?

Transfer pricing is relevant in situations where a group of companies, owned by the same shareholders, or with one company being owned by the other, need to exchange funds for goods or services. It is a method used to determine the appropriate price for these transactions between related parties. While one might think to simply transfer the necessary funds to cover costs or continue operations, it is not as straightforward as it seems. Allocating the correct price becomes crucial as it can potentially generate taxable profits in specific regions. This concept is especially important in cross-border scenarios, where companies have been known to utilize transfer pricing to shift profits to jurisdictions with lower tax rates, thereby avoiding paying taxes. To prevent such manipulation, international taxation bodies have developed transfer pricing rules. Therefore, transfer pricing becomes relevant when there is a need to establish accurate pricing for transactions between related entities, particularly in cases involving multinational companies.

3. How does transfer pricing work? And how to determine the transfer price?

There is a set of rules around how transfer pricing should be established. These rules can vary from country to country, but in general:

- The transfer price is established by comparing a good or service with another good or service.

- The terms of sale are similar to those negotiated between unrelated parties.

Sounds simple, right? But what is "comparability" and how to establish it? How to do the comparability analysis? The critical point here is that multinational corporation does not just pick the price out of thin air. There are different methods and approaches to arrive at it. OECD, the international organization, published 600+ pages of guidelines on how the transfer prices should be determined for tax purposes, and taxpayers must follow the rules (if they don't want to be challenged by tax authorities and face transfer pricing issues). The document is called the "OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations". Most of the countries in the world follow the OECD standard with some minor deviations.

4. What is Transfer Pricing as a Profession?

Transfer pricing specialists deal with two tasks - first, they need to determine the transfer price to be charged in the intercompany transaction. Second, they need to prepare a set of documents to prove to tax authorities that the price is at an appropriate level.

If you are interested in knowing more about transfer pricing profession, check out blog post below:

5. How to Study Transfer Pricing?

Transfer pricing is full of various rules, guidelines, and transfer pricing regulations regulations that corporations must follow to comply with different countries' laws. This can make transfer pricing a somewhat tricky topic to study. Many accountants and auditors are not familiar with it, and some even consider it illegal. However, it is possible to learn about transfer pricing and become a skilled professional who can apply the skills needed to do this job. It's also an exciting area that can be pretty rewarding.

6. When should a company start thinking about transfer pricing?

You should start thinking about transfer pricing as soon as your company begins conducting transactions involving the transfer of money between different companies. It is important to address this matter promptly, even if you have already been engaging in such transactions without awareness of transfer pricing. It is recommended to consult with an accountant at the earliest opportunity.

Furthermore, it's essential to understand that considering transfer pricing is not a one-time task. It should be periodically reviewed to ensure that the proper prices are established. Make sure to maintain all documentation related to transfer pricing and the ongoing reviews. Having this documentation on hand can be helpful for future reviews or when presenting your business to potential investors, as it demonstrates your commitment to corporate responsibilities and risk mitigation.

An annual review is ideally conducted, or more frequently if there are changes in the nature of the transactions, costs, the wider economic environment, or tax regulations that may warrant it.

By changes in costs, we are referring to significant, incremental changes, rather than normal expected fluctuations which can be accounted for in the pricing calculation.

7. Other questions

What is the Comparable Uncontrolled Price (CUP) Method?

The Comparable Uncontrolled Price (CUP) Method involves comparing the price of a good or service in a controlled transaction with the price of a comparable good or service in an uncontrolled transaction between unrelated parties. The transfer price is then set at a level that aligns with what would be charged in an arm's length transaction. This method is based on the principle of market comparability.

How is transfer pricing reported and what documentation is needed?

Transfer pricing transactions must be reported, and it is mandatory to have supporting documentation. To report transfer pricing accurately, an accountant or transfer pricing advisor can provide a document template that complies with the reporting requirements. This documentation includes details of the transfer pricing method used, supporting data, and any relevant financial information.

What are the potential complexities and hybrid models in transfer pricing?

Transfer pricing can become complex due to various factors. Hybrid models, which combine or modify different transfer pricing methods, can add to the complexity. Additionally, the unique characteristics of certain industries or scenarios may require a tailored approach, making transfer pricing calculations more intricate.

Why is it important to involve an accountant or transfer pricing advisor in transfer pricing calculations?

Involving an accountant or transfer pricing advisor in transfer pricing calculations is crucial for several reasons. Firstly, they have expertise in this area and can provide guidance on the appropriate method to use. Secondly, they are familiar with the reporting requirements and can assist in preparing the necessary documentation for end-of-year filings. Lastly, an accountant or transfer pricing advisor can help with the annual review of transfer pricing to ensure compliance.

What are the five basic methods used to calculate transfer pricing?

There are five basic methods for calculating transfer pricing, all based on the 'arm's length' principle. These methods are the Comparable Uncontrolled Price (CUP) Method, Cost-Plus-Percent Method, Resale Price Method, Transaction Net Margin Method (TNMM), and Profit-Split Method. Each method has its own suitability depending on the industry or process involved.

For more details about the textbook and the course, contact us:

Featured links

Get your free TP cheat sheet!