Transfer pricing and Transparency – Country-by-Country Report

As part of BEPS Action 13, OECD introduced the Country-by-Country Reporting (CbCR) for large multinationals. This was a completely new requirement and was believed to change MNE’s tax practices substantially.

Transparency initiatives and voluntary disclosure

In 2016, the European Commission proposed a directive requiring

large MNEs to publish their CbC reports on an annual basis. The proposal was

blocked by several countries that were concerned about privacy issues and the

business competitiveness of EU companies. However, public CbC reporting is

still high on the agenda, and many countries and non-governmental organisations

advocate for legislation requiring MNEs to disclose their CbCRs.

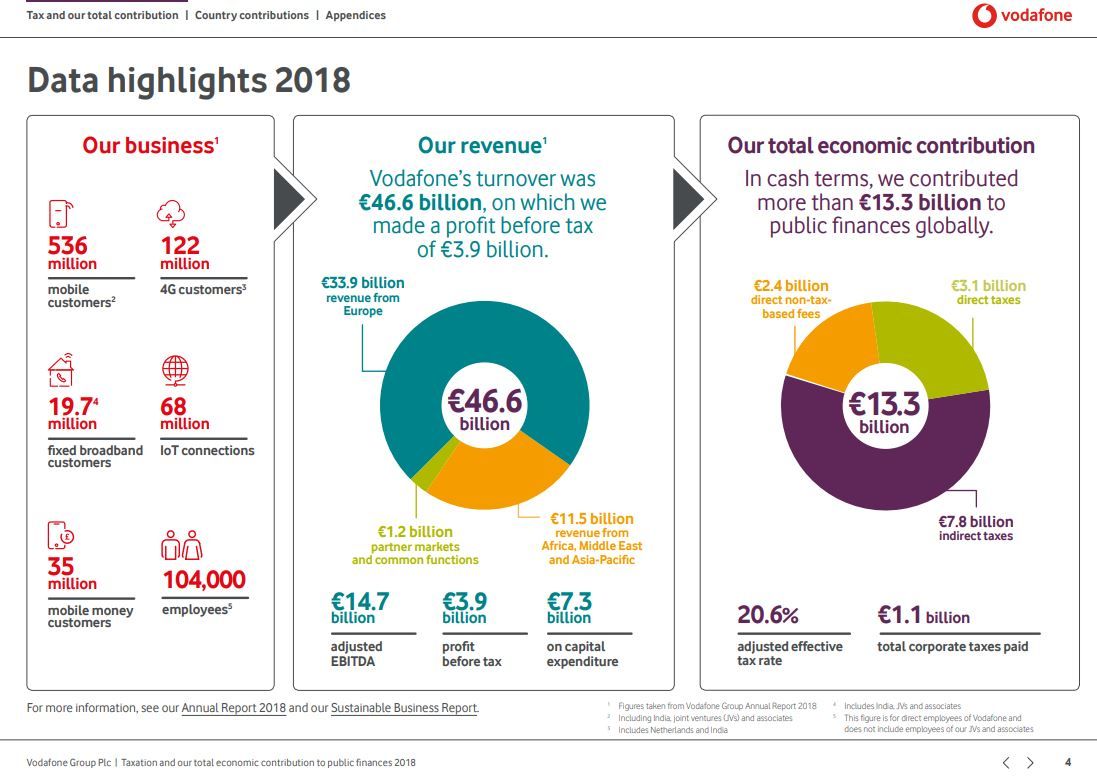

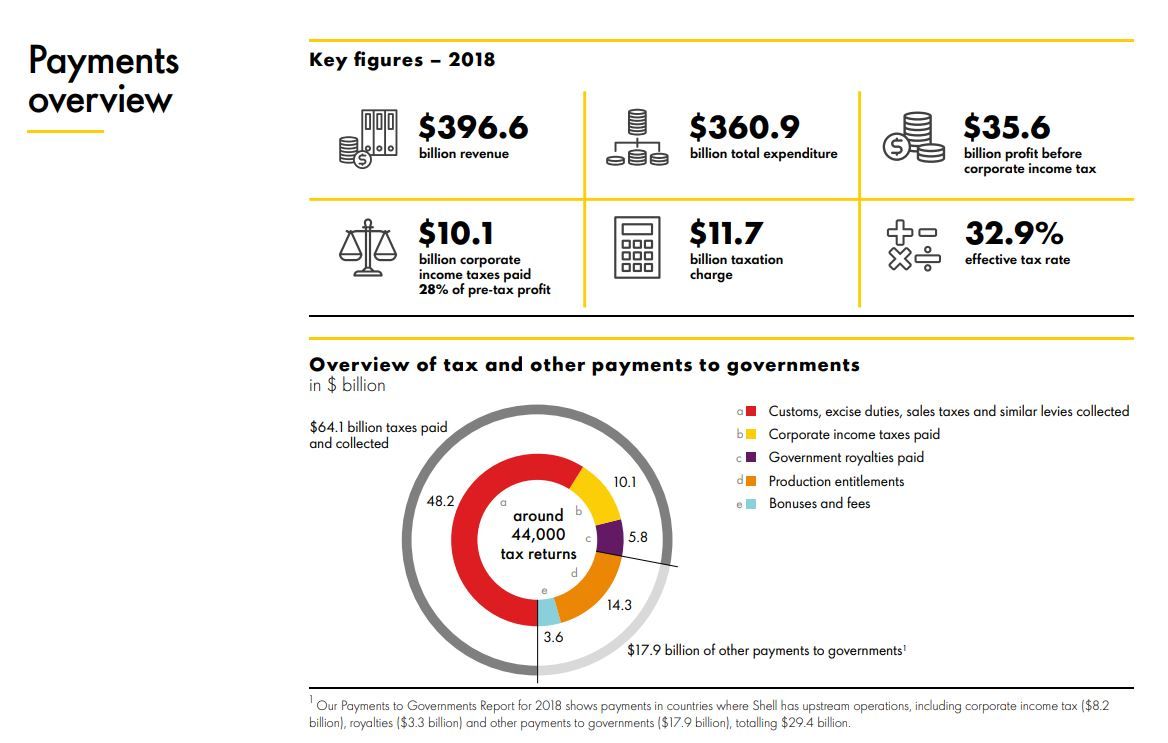

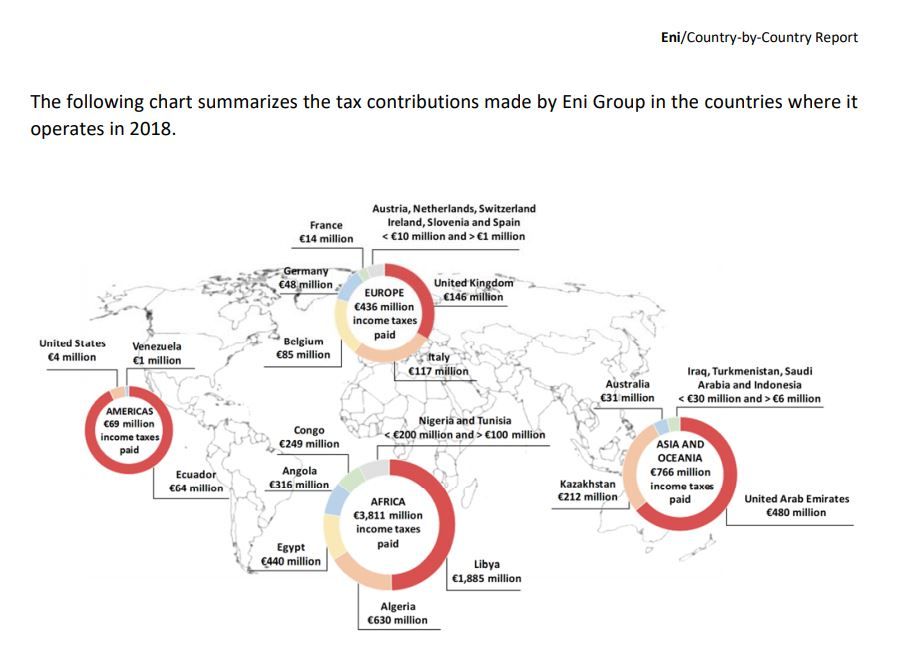

Some MNE groups made the decision to publish their global tax data

proactively. One of the first companies to do so was Vodafone. Another recent

example is a large oil and gas company, Royal Dutch Shell, which published the

“2018 Tax Contribution Report” (including CbCR data) and plans to do so

annually. These reports and initiatives provide valuable insight into the tax

practices of MNEs and create trust between businesses, governments, and the

public. Below are summaries – click on them to access full reports:

Vodafone: Taxation and our total economic contribution to public finances 2018

In our transfer pricing course, we dedicate several lectures and quizzes to the discussion about CbCR and transparency – join our classes for more details. Also, check our textbook – it also provides valuable details on this topic.

✉ Contact us for more details: study@startaxed.com

Featured links

Get your free TP cheat sheet!