What are

other CCA elements that are critically important from your perspective? Let us know,

and we will add them to the list!

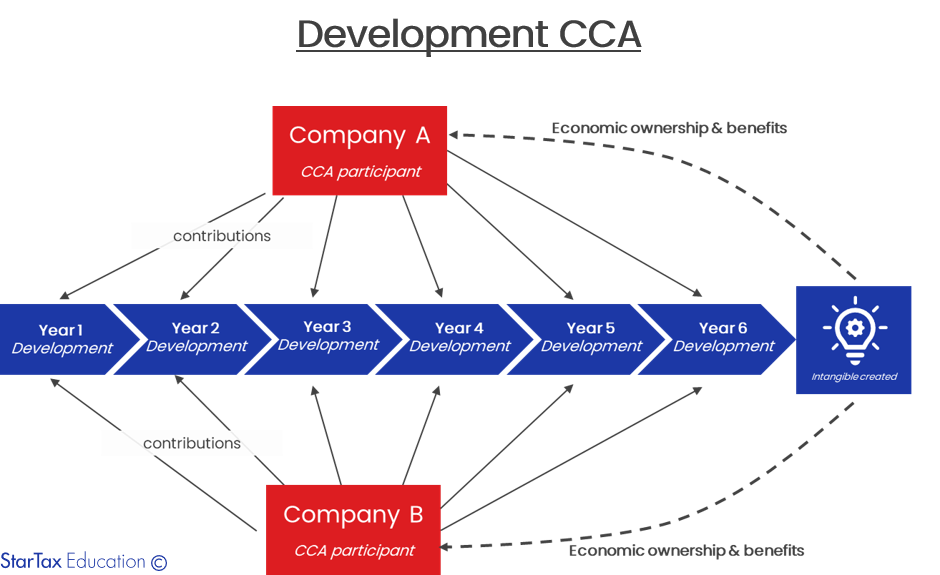

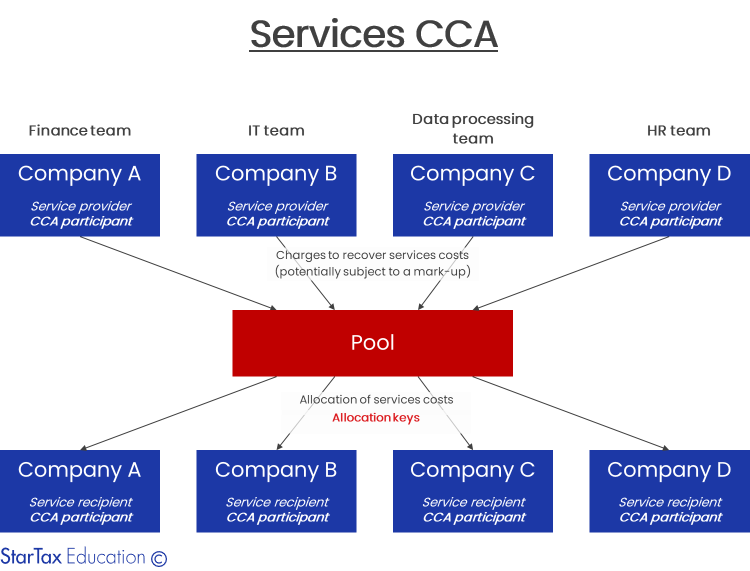

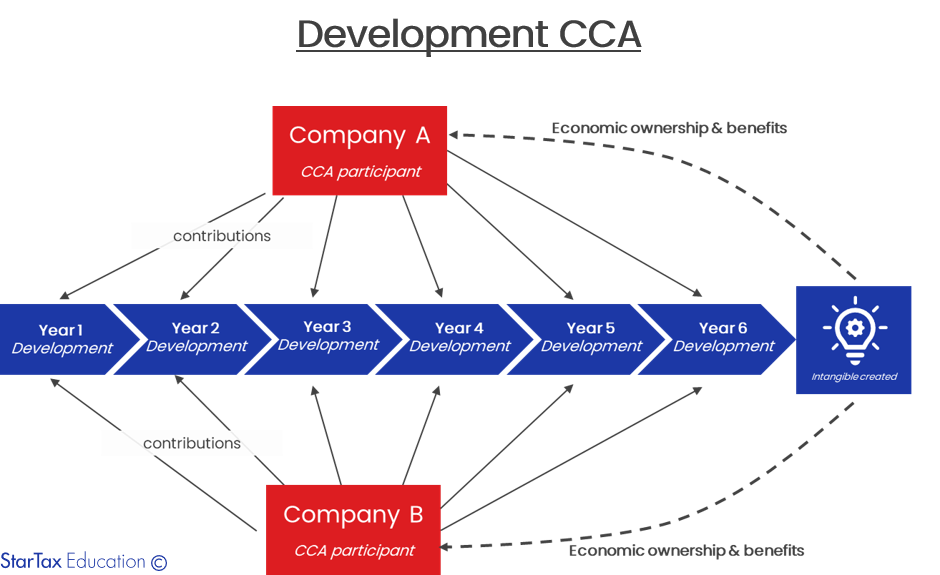

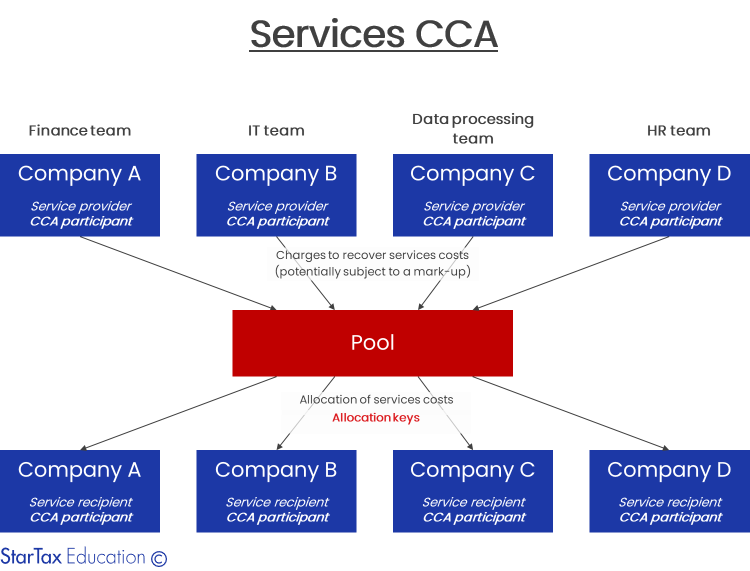

In our

textbook, we dedicate a detailed chapter for the discussion about CCAs, including

8 practical examples and cases that explain services and development CCAs.