OECD COVID-19 Transfer Pricing Guidance: What Does It Say?

Borys Ulanenko

On 18 December 2020, the OECD published a report on the transfer pricing implications of the COVID-19 pandemic (the OECD COVID Guidance). This is a long-awaited document that discusses important aspects of transfer pricing during the pandemic, which may be helpful for both taxpayers and tax administrations worldwide. Importantly, the report represents the consensus view of the 137 members of the Inclusive Framework, which makes it relevant in (almost) every country of the world.

Even though the OECD

COVID Guidance does not provide detailed instructions, it is still helpful as

it gives general principles of the application of the arm's length principle during

COVID pandemic. Notably, the OECD provides "no-go" options that

taxpayers could consider before, but are now clearly not recommended.

The OECD COVID Guidance

focuses on four priority areas that we summarized below. The document is

structured in the FAQ manner, i.e. provides popular questions and answers to

them.

As a general approach,

though, the OECD COVID Guidance highlights that the arm's length principle

should be applied in the same way as described in the OECD Guidelines, and the COVID-19 pandemic just makes it's application

more difficult from a practical perspective.

Summary

I. Comparability analysis

The OECD COVID Guidance

makes it clear that comparability analysis is difficult during the pandemic due

to several reasons, in particular:

- Lack of information about the effect of the pandemic on comparables (and the economy as a whole)

- Timing issues (especially for the TNMM application)

- Issues with

comparability (i.e., due to different government assistance programs in different

countries)

The OECD COVID Guidance

provides several practical approaches to address information deficiencies, and,

more generally, comparability difficulties:

II. Losses and allocation of COVID-19 specific costs

As a general principle, the OECD COVID Guidance highlights that losses and COVID-19 specific costs should be split in line with the risk allocation between parties of the transaction. Parties should align the allocation of exceptional, non-recurring costs (i.e. PPE costs) with how independent enterprises' would allocate them.

- Use of reasonable commercial judgement to set an estimate of the arm's length price (supported by contemporaneous information);

- Allowing the use of "price testing" approach (where "price-setting" was used in the past) and greater flexibility to use compensating adjustments; ensuring access to MAP to avoid double taxation; Use of more that one transfer pricing method;

- Use of more segmented periods for price testing (or price setting), or, alternatively, a greater level of aggregation (i.e. comparing the results of the controlled transaction for several years, combined);

- Where one of the comparability factors is considered the most relevant (i.e. geography) - greater flexibility around other comparability search criteria.

II. Losses and allocation of COVID-19 specific costs

As a general principle, the OECD COVID Guidance highlights that losses and COVID-19 specific costs should be split in line with the risk allocation between parties of the transaction. Parties should align the allocation of exceptional, non-recurring costs (i.e. PPE costs) with how independent enterprises' would allocate them.

One of the most burning COVID-19 pandemic TP questions is if limited risk entities can incur losses. The OECD COVID Guidance does not go beyond what is written in the OECD Guidelines. One of the important takeaways is that OECD urges against generalizing the "limited-risk" entities and highlights that each case is unique. I.e., if the entity was bearing the marketplace risk that played out during the pandemic, it could incur losses, if not – then no marketplace risk losses should be assigned to it.

Consistency between risk allocation and profits/losses distribution is critically important, and the OECD makes it clear that modifying functional analysis to substantiate the loss is not a good idea.

This section also provides more detailed guidance on how exceptional costs should be taken into account in a comparability analysis and the effect of force majeure clauses on the losses allocation.

III. Government assistance programs

Generally, the OECD COVID Guidance recognizes that there are various types of government assistance, and it is difficult to develop one size fits all approach. The availability, substance, duration and take-up of these programs will differ and may have different transfer pricing implications. Some general principles on transfer pricing implications of government assistance programs are summarized below:

- Government assistance is an economically relevant characteristic, where it has a substantial economic effect (i.e., wage subsidies, liquidity support, etc.)

- In line with the OECD Guidelines, government interventions should be treated as conditions of the market

- Taxpayers and tax administrations should carefully consider if the government support affects prices in the controlled transaction (and related transactions with third parties), the enterprise's cost base, and how these effects should be accounted for.

- Since government assistance programs are country-specific, benchmarks that use comparables from other countries can become less relevant.

IV. Advance Pricing Arrangements (APAs)

The issue of APAs during the COVID-19 pandemic is especially relevant. The main problem is that many APAs concluded by taxpayers in the past include critical assumptions around economic conditions' stability. Obviously, the pandemic leads to significant changes to the environment, and therefore, a potential breach of critical assumptions.

The OECD COVID Guidance encourages taxpayers to adopt a collaborative and transparent approach by raising COVID-19-related issues with the relevant tax administrations in a timely manner. The document highlights that tax administrations should consider every APA on a case-by-case basis. The report considers three potential outcomes for APAs and provides details on the reasons for choosing these options by tax administrations:

- Revision: The APA still applies for the whole period, although terms can be adjusted.

- Cancellation: The APA is in effect only up to the cancellation date.

- Revocation: The

APA is treated as having never been entered into.

The OECD COVID Guidance recognizes difficulties taxpayers and tax administrations face while negotiating APAs during the COVID pandemic. These include both fundamental issues (uncertainty, business changes, etc.), as well as practical problems (travel limitations, no f2f meetings, etc.). Nevertheless, the document notes that despite potential challenges, the value of achieving advanced certainty and effective dispute prevention through APAs remains compelling.

Is the OECD COVID Guidance relevant for the ADIT exam?

The short answer is “no”, as the OECD COVID Guidance is not included in the ADIT syllabus for 2021, and it is not intended to become the part of the OECD Guidelines in the future. However, there is a chance that CIOT will include some questions about transfer pricing during uncertain times and crises. The OECD COVID Guidance is not only relevant for the COVID-19 pandemic, but can also be useful for issues faced by MNEs and tax administrations while dealing with transfer pricing in other crisis situations.

We also discuss practical considerations of the COVID-19 pandemic in Module 18 of our transfer pricing course, as well as in the textbook.

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

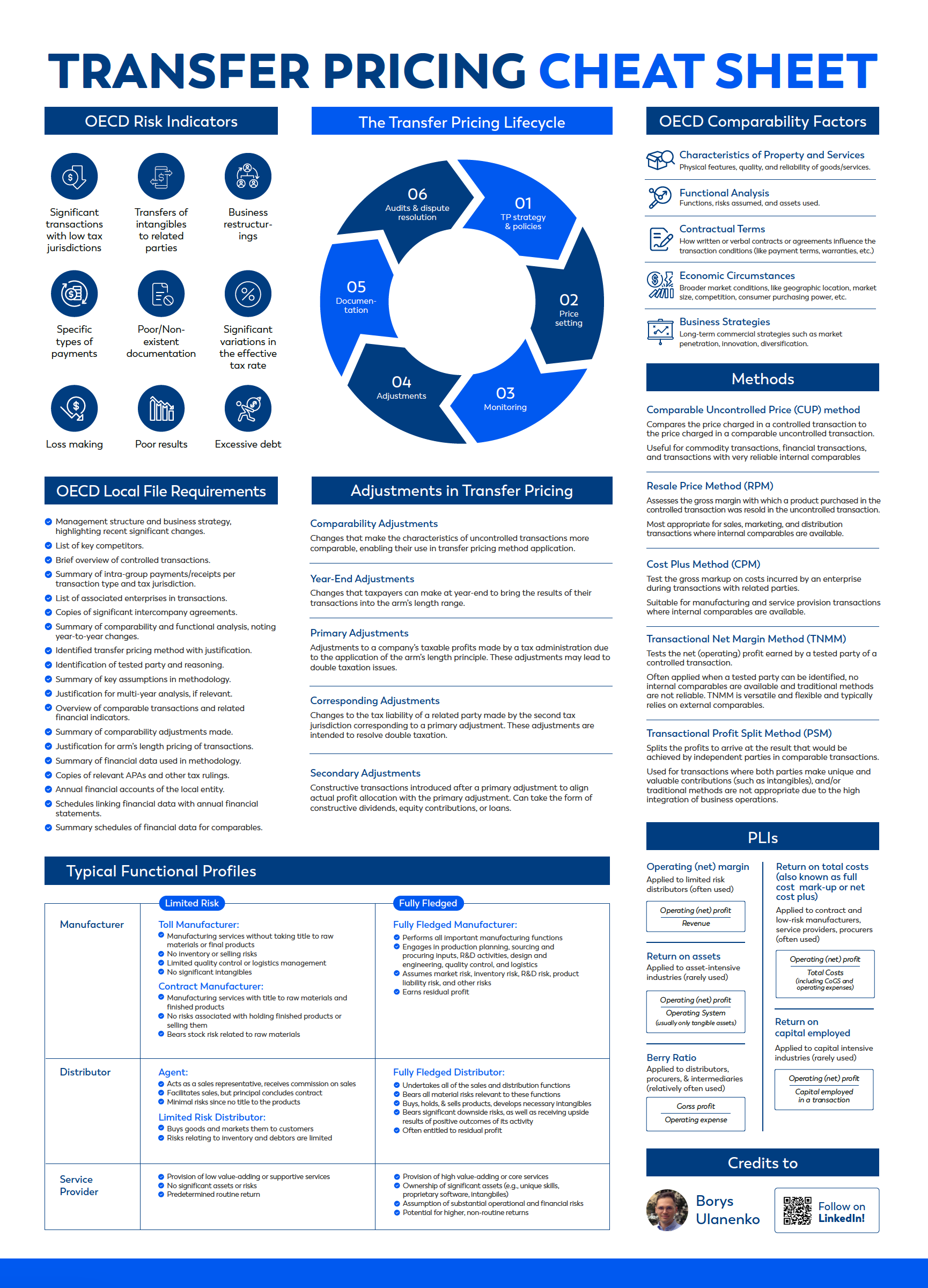

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.