What is entity characterisation? Limited risk distributors, contract manufacturers, and other profiles.

Oct 8

/

Borys Ulanenko

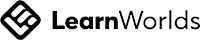

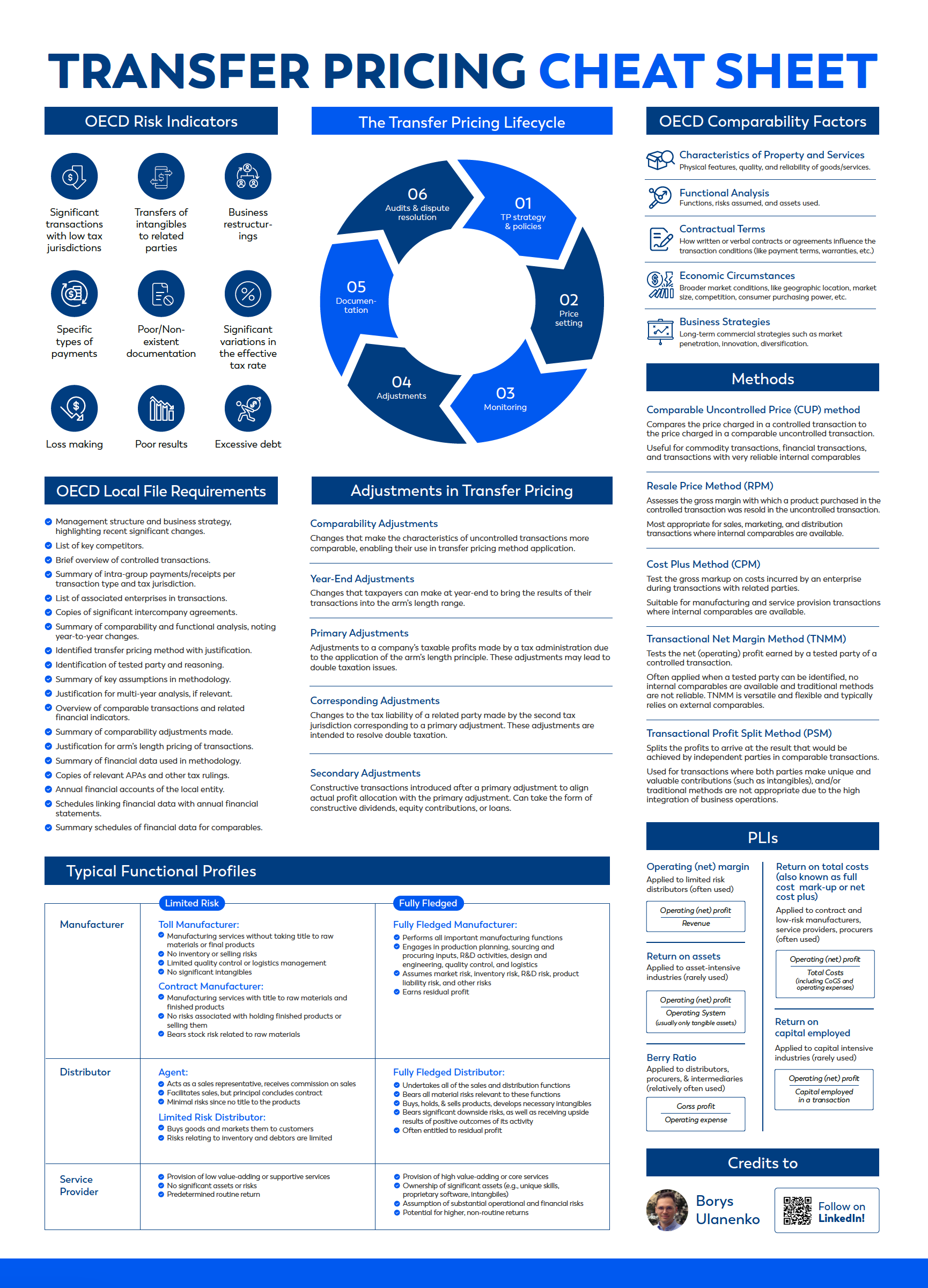

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Quick Reference: Key Transfer Pricing Principles Summarized

Have all core TP concepts at your FINGERTIPS

Get your free TP cheat sheet!

Thank you! Download here.

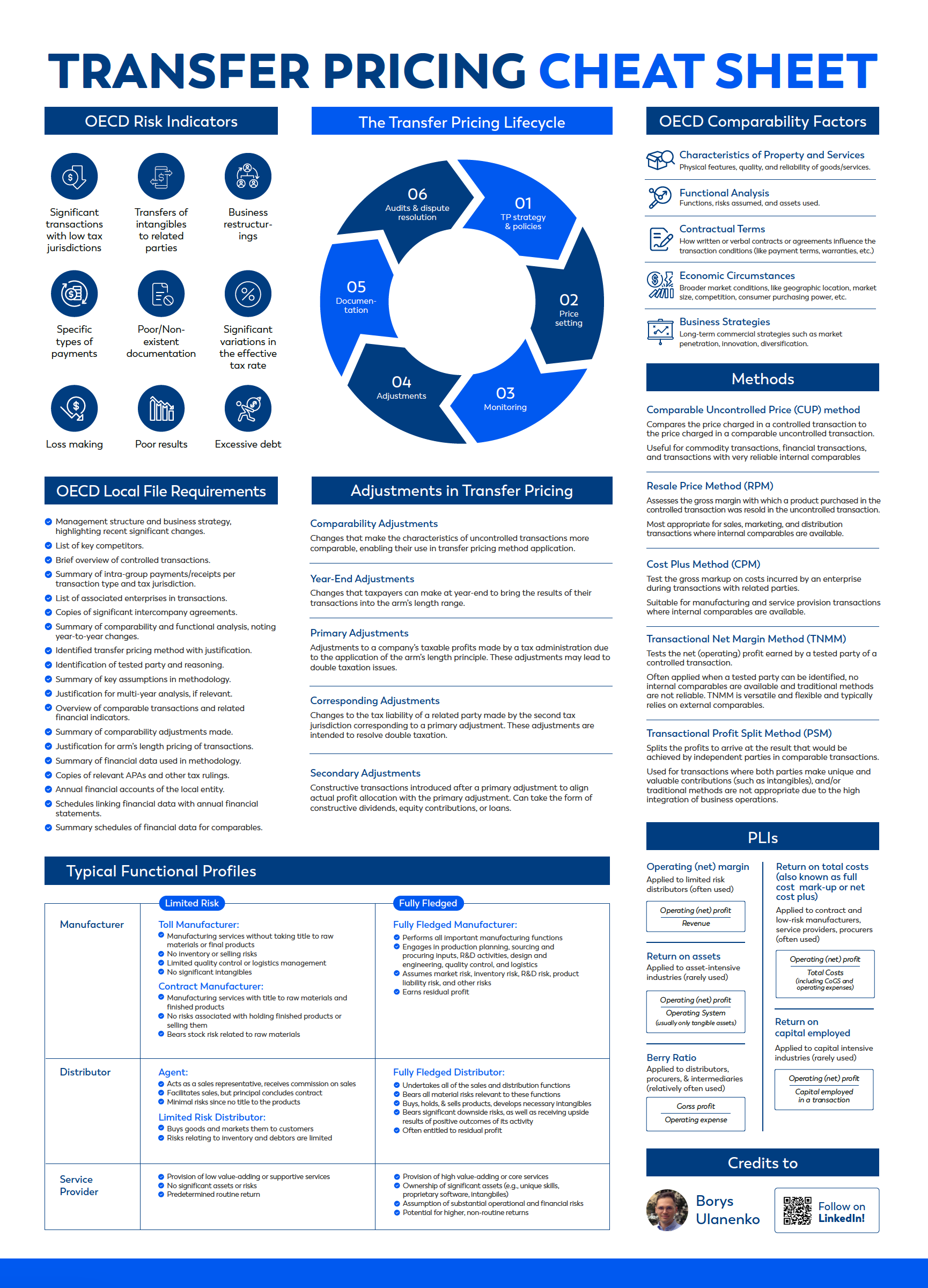

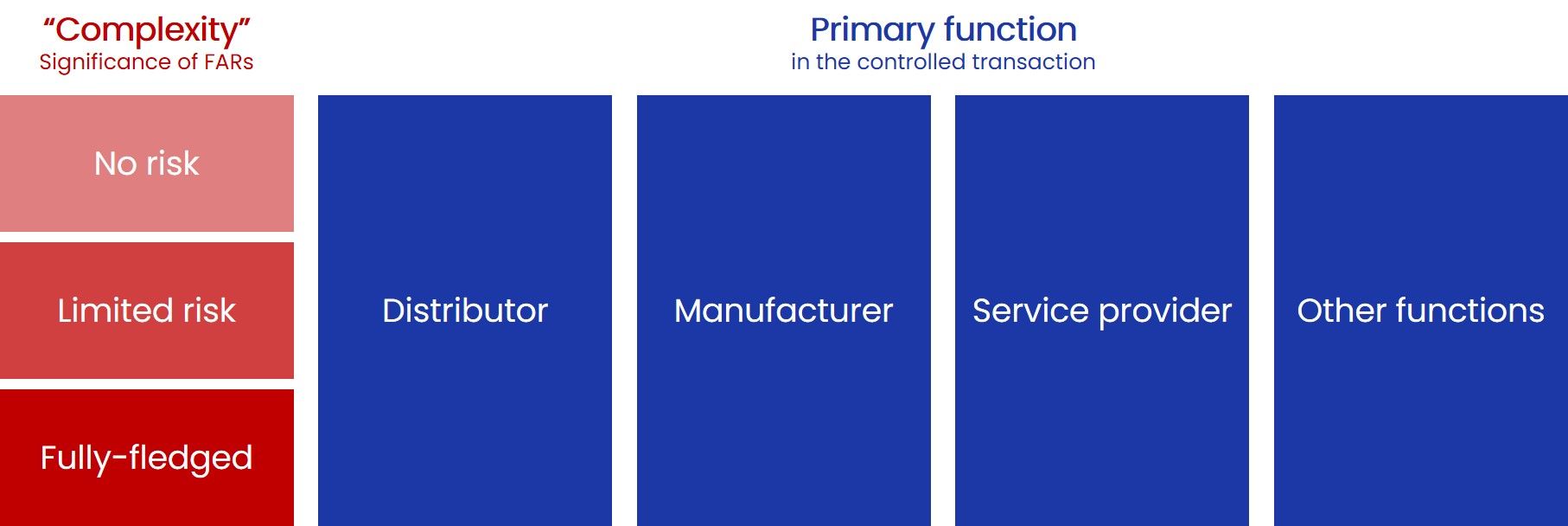

Multinational enterprises (MNEs) often segregate their business operations into several functional elements that, in combination, form an end-to-end supply and value chain. Since the current international tax regime is based on the separate entity approach, every entity within an MNE should be adequately remunerated for functions, assets, and risks that it contributes to the value chain. When doing transfer pricing analysis, we identify economically important functions, assets, and risks, and draw conclusions about (1) the primary role of controlled transaction participants, and (2) the degree of "complexity" of the role they play. The process of labelling entities with high-level "tags" is known as entity characterisation, and these "tags" are sometimes called functional profiles. The key purpose of the exercise is to understand the allocation of risk between the companies - in other words, how the business risks are allocated in the value chain. This also helps to determine transfer prices or margins (such as operating profit margins) in transfer pricing arrangements.

Why is it important?

According to the arm's length principle, comparable functions, risks, and assets should be compensated similarly. In practice, however, it is very difficult to evaluate each function and risk separately, and some degree of aggregation and generalisation is necessary. Assigning the entity characterisation "tag" therefore, allows us (1) to have a preliminary feeling about the allocation of risk and the profit potential of the entity, and (2) to determine which comparable companies or transactions we should look for during the comparability analysis. Both elements have immediate transfer pricing implications and affect the transfer pricing method selection.

If you are going to take the ADIT transfer pricing exam, you also need to bear in mind that entity characterisation is included in syllabus ("Functional analysis" module). Therefore, knowing the main functional profiles and the approach to entity characterisation is crucial for the successful exam sitting.

How to characterise an entity for transfer pricing purposes?

Entity characterisation summarises the functional analysis, therefore it is necessary first to identify economically significant functions, assets and risks of companies participating in the controlled transaction. Then, we need to compare the functions, assets and risks of each party with typical functional profiles (such as "limited risk distributor", or "contract manufacturer"). In real life, of course, it is difficult to find pure functional profiles, and therefore we need to allow for some degree of flexibility. Entity characterisation can be explicitly or implicitly determined by the group's transfer pricing policy.

Examples

Let's assume that during functional analysis, we identified that one party of the transaction is responsible for the manufacturing of products. The manufacturer buys raw materials and takes title to finished goods. The company does not own unique and valuable intangibles, and only uses routine manufacturing know-how and technologies that are widely available in this industry. The manufacturer produces goods on request of the principal, and the principal guarantees to purchase ordered goods from the manufacturer (if they meet quality standards). Based on these facts, we can conclude that the company can be characterised as a contract manufacturer.

Knowing transfer pricing methods and approaches to comparability analysis, we can assume that the contract manufacturer will be selected as a tested party. There is a good chance of using the Transactional net margin method (TNMM) and testing the remuneration of the contract manufacturer on a cost-plus basis (if internal comparables are not available).

Knowing transfer pricing methods and approaches to comparability analysis, we can assume that the contract manufacturer will be selected as a tested party. There is a good chance of using the Transactional net margin method (TNMM) and testing the remuneration of the contract manufacturer on a cost-plus basis (if internal comparables are not available).

Typical entities in manufacturing are:

• Toll manufacturers - entities that processes raw materials or semi-finished goods for another company. Essentially, a toll manufacturer provides the service to the principal without taking title to the raw materials or final products.

• Contract manufacturers - similar to a toll manufacturer, a contract manufacturer executes manufacturing functions for a principal. However, contrary to a toll manufacturer, a contract manufacturer takes title to the raw materials and finished products. Provided it meets specified quality and quantity, a principal will guarantee to buy all the goods manufactured.

• Fully-fledged manufacturers - a fully-fledged manufacturer executes all important manufacturing functions and bears associated risks. It usually engages in production planning, sourcing and procuring inputs, R&D activities, design and engineering, quality control, and logistics. A fully-fledged manufacturer assumes the market risk, inventory risk, R&D risk, product liability risk, and other risks depending on the MNE structure.

In distribution:

• Commission agents and commissionaires - they do not usually purchase products and resell to the customer, but instead operate as sale representatives and receive a commission on the sales to customers (the commission is often calculated as a percentage of the price paid by the customer). An agent is responsible for interaction with the customers and facilitates sales, but the terms of the sale and the contract for sale itself are agreed upon and concluded by the principal. An agent does not take title to the products and therefore incurs minimal risks. While a distributor reports revenue as the amount of the product sold to customers, an agent generally reports income as the amount of commission received from the supplier, which is often a small fraction of the third-party sales.

• Limited risk distributors - a Limited-Risk Distributor (LRD) is a distribution company that buys goods and markets them to customers. LRDs can sometimes contribute to marketing activities. The arrangement between the distributor and principal significantly limits LRD risks. Risks relating to inventory and debtors will be effectively controlled and covered by the principal. For example, the obsolete stock will be bought back, bad debts will be reimbursed, etc. The market risk will also be limited for the LRD. Such a distributor typically does not develop significant marketing intangibles. The material difference between an agent and the LRD is that the LRD takes the title of the product, which leads to more significant functions and risks compared with an agent. However, these functions and risks are still limited. The LRD would usually earn limited profit measured as a return on sales (margin).

• Licensed distributor (this model is sometimes skipped and combined with a FFD - read below) - a Licensed Distributor is an individual or entity that operates by utilizing intangible assets through licensing agreements. These assets can include brands, patent-protected technology, software, or databases. Unlike owning these assets outright, the Licensed Distributor has obtained formal permission or authority to use them. One of the primary responsibilities of a Licensed Distributor is deciding the quantity of goods they will purchase and sell. This decision-making process exposes them to both inventory and market risks. In other words, they must carefully assess and manage the amount of inventory they acquire and the market conditions they operate within. Additionally, a Licensed Distributor assumes functions and risks similar to those of a fully-fledged distributor. This means that they may need to handle tasks such as marketing, sales, order fulfillment, and customer support. They are entrusted with the distribution of the products or services associated with the licensed assets. Overall, a Licensed Distributor operates by leveraging licensing agreements to access intangible assets. They are responsible for strategically managing inventory, making informed decisions about product quantities, and performing various functions typically associated with distribution.

• Licensed distributor (this model is sometimes skipped and combined with a FFD - read below) - a Licensed Distributor is an individual or entity that operates by utilizing intangible assets through licensing agreements. These assets can include brands, patent-protected technology, software, or databases. Unlike owning these assets outright, the Licensed Distributor has obtained formal permission or authority to use them. One of the primary responsibilities of a Licensed Distributor is deciding the quantity of goods they will purchase and sell. This decision-making process exposes them to both inventory and market risks. In other words, they must carefully assess and manage the amount of inventory they acquire and the market conditions they operate within. Additionally, a Licensed Distributor assumes functions and risks similar to those of a fully-fledged distributor. This means that they may need to handle tasks such as marketing, sales, order fulfillment, and customer support. They are entrusted with the distribution of the products or services associated with the licensed assets. Overall, a Licensed Distributor operates by leveraging licensing agreements to access intangible assets. They are responsible for strategically managing inventory, making informed decisions about product quantities, and performing various functions typically associated with distribution.

• Fully-fledged distributors - a Fully-Fledged Distributor (FFD) undertakes all of the sales and distribution functions, performs marketing activities and bears all of the material risks relevant to these functions. It buys, holds, and sells products, develops necessary intangibles, and has significant downside risks, as well as receiving upside results of positive outcomes of its activity. The FFD usually incurs material costs to execute its functions and is often entitled to residual profit. A Full-Fledged Distributor (FFD) has the potential for significant profit due to their engagement in various operational and entrepreneurial activities related to marketing, distribution, and sales. By assuming responsibilities in these areas, FFDs also bear multiple risks, including price risk, volume risk, credit risk, market risk, marketing intangibles risk, risk on unsaleable stock, obsolescence of stocks, reclamation of goods, and currency risk. The combination of assuming these risks and actively participating in the market can lead to substantial earnings for FFDs. However, it is important to note that these earnings are also highly susceptible to volatility. Market fluctuations and changes in various factors can significantly impact the FFD's profitability. Thus, while the potential for profit is high, the earnings of FFDs tend to experience notable fluctuations due to the inherent volatility of the market environment.

Service providers:

• Low value-adding service providers

• Classic contract service providers

• Sophisticated service providers

We discuss the topic in our ADIT transfer pricing course "Functional Analysis in Practice" module, where we have lectures on entity characterisation and typical functional profiles, as well as detailed FAR analysis and entity characterisation demo. Also, check pages 58-67 of our textbook for a detailed description of standard functional profiles.

If you are interested in this topic, we also recommend the book "Transfer Pricing and Business Restructurings: Streamlining All the Way" (IBFD, edited by Anuschka Bakker).

If you are interested in this topic, we also recommend the book "Transfer Pricing and Business Restructurings: Streamlining All the Way" (IBFD, edited by Anuschka Bakker).

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.