Why Taking the Transfer Pricing ADIT Exam First Makes the Most Sense

Borys Ulanenko

One of the first decisions that ADIT candidates must make is which exams to take, and which exams to take first. There is only one exam that every student should pass (“Principles of International Taxation” module), while two others can be chosen from a list which includes both jurisdiction and thematic modules.

Principles of

International Taxation module

This module is based on the OECD Model Convention, and

is mandatory for all candidates. The focus is on key issues such as Principles

of International Tax Law, Residence, Double Taxation Conventions and Treaty

interpretation, transfer pricing, the work of the OECD and international tax

avoidance.

Jurisdiction modules

Candidates are expected to have detailed knowledge of

a country’s tax regime regarding international tax matters.

Thematic modules

Candidates are expected to have a

detailed knowledge of international tax issues concerning a specific area of

taxation, or a transnational grouping such as the EU, and should be able to

answer questions on international tax in relation to the chosen subject. This

may require awareness of multiple countries’ tax systems, to the extent that

those systems interact with the chosen area of taxation.

Which exams to chose?

Choice of exams is very individual, and we are usually careful with advising about which exams to take. There are some questions, though, that candidate should ask him/herself:

- Where am I located and which jurisdiction I am mostly working for (or want to work in the future)? It may make sense to take jurisdiction exam if the candidate mainly works for one country.

- What areas of tax am I mainly engaged in? It may be relevant to focus on VAT or transfer pricing if the person works in these areas.

- Am I working and planning to work for a specific industry? ADIT provides an option to choose Banking or Upstream Oil and Gas modules, which are very useful for someone working in/for these industries.

Here are two hypothetical candidates that can make completely different choices.

John is a young tax specialist located in Texas, US. John works for Big4 company and mainly supports direct tax and transfer pricing matters of local companies and multinationals headquartered in Houston, TX. John likes his job and wants to continue working in his company, eventually moving to an in-house role. John may consider choosing United States ADIT module as a jurisdiction option. He also can select Upstream Oil and Gas module and/or Transfer Pricing modules, as he mostly works for oil and gas companies and transfer pricing issues are high on the agenda.

Evan lives in Hague, Netherlands. Evan works for the technology company X which has a regional office in NL. Evan is mainly responsible for direct tax matters of X in Western and Central Europe. Since Evan works with many jurisdictions, taking jurisdiction modules maybe not the best option for him. Instead, Evan may consider taking the EU Direct Tax and Transfer Pricing exams.

Why taking the Transfer Pricing ADIT exam first makes the most sense

If you think that taking the Transfer Pricing exam is generally a good option for you, taking this module first may make the most sense.

Even though transfer pricing is an integral part of international tax law, it is still quite detached from the rest of the tax areas. As a result, Transfer Pricing ADIT exam includes transfer pricing-focused question, and therefore the knowledge you gain in other exams is not of much help here. Synergy effects are quite limited, and therefore you won’t benefit much if you pass jurisdictional or another thematic module first. Of course, some transfer pricing knowledge is required to pass the Principles of International Taxation exam, but the transfer pricing skills you gain while preparing for it are quite limited.

In contrast, if you choose to sit the Transfer Pricing ADIT exam first, you can actually benefit from your transfer pricing knowledge and skills in other exams. On average, 25-30% of points in the Principles of International Taxation exam and more than 25% in the Upstream Oil and Gas exam are assigned to transfer pricing-related questions. Similarly, jurisdiction modules and Banking option also sometimes include questions related to the arm’s length principle or related procedures (like MAPs). Therefore, by taking the Transfer Pricing exam first, you effectively prepare for other future exams at the same time.

What is your opinion? Which exams do you plan to take, and what was the sequence? Share your experience with us!

We discuss exam strategies and share hints and tips in our textbook and the transfer pricing course.

We discuss exam strategies and share hints and tips in our textbook and the transfer pricing course.

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

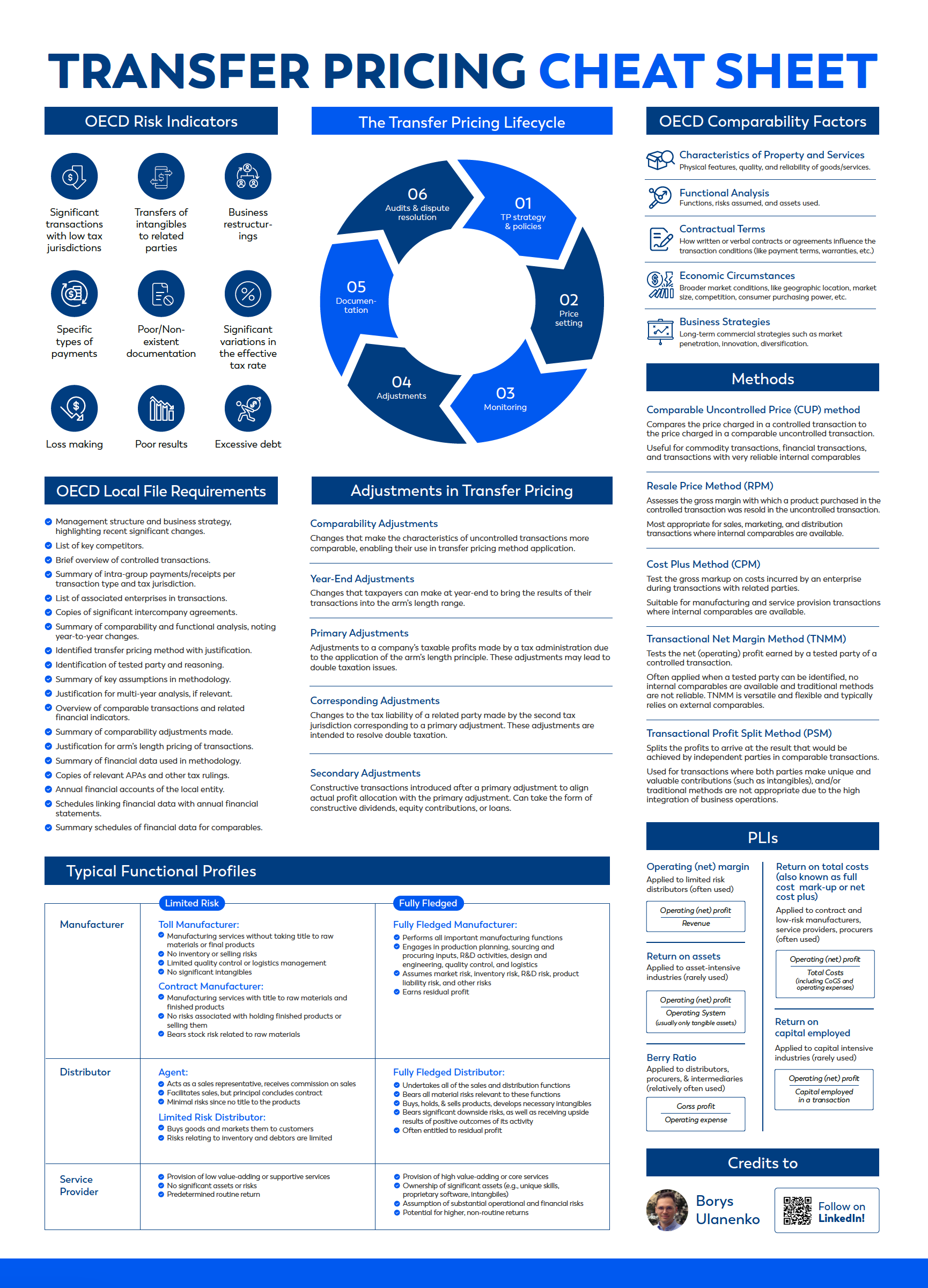

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.