Transfer Pricing Functional Analysis and Interviews, and 6 Steps to Successfully Perform Them

Nov 26

/

Borys Ulanenko

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Quick Reference: Key Transfer Pricing Principles Summarized

Have all core TP concepts at your FINGERTIPS

Get your free TP cheat sheet!

Thank you! Download here.

Functional analysis is an essential part of transfer pricing. Recent international tax developments and disputes have demonstrated that functions, risks, and assets play a critical role in determining the transfer pricing methodology to be applied in controlled transactions. The OECD’s approach to functional analysis was also amended during the BEPS project.

Functional analysis is a process of identifying and analysing economically significant functions executed by the parties, risks

taken, and assets used in the transaction. In real life, doing functional analysis

will usually require conducting a series of functional interviews.

Why is functional analysis important?

Functional analysis supports the attribution of profits to each entity in a controlled transaction by ensuring that the profits attributed are appropriate to the functions performed, assets employed, and risks assumed by each entity. A thorough functional analysis helps in accurately determining the contribution of each entity and justifying the allocation of profits based on their respective roles and responsibilities. In other words, functional analysis determines appropriate compensation by identifying who is benefiting from a transaction. It recognizes that one entity may perform a particular function while another entity bears the risk. By assessing the economic reality of the transaction and considering the functions, risks, and benefits involved, functional analysis helps determine fair compensation.

Functional analysis plays a key role in determining the appropriate transfer pricing method for a transaction. By identifying, analyzing, and evaluating the functions performed, risks taken, and assets used by the parties involved, functional analysis provides essential information to select the most suitable transfer pricing methodology.

Also, the characterizations of functions performed by entities (aka entity characterization) play a crucial role in selecting reliable comparables. By characterizing functions such as manufacturer, distributor, sales agent, etc., one can identify entities that have similar characteristics, making them suitable for comparison purposes.

What is the role of functional analysis in TP documentation?

Functional analysis provides the foundation for organizing transfer pricing documentation. By piecing together the puzzle of functions, risks, and benefits, it establishes a clear understanding of the transaction. This understanding then facilitates the organization of other transfer pricing documentation, ensuring that it aligns with the economic reality revealed through functional analysis.

In other words, functional analysis serves the purpose of telling the story of an MNE's transactions, highlighting the different functions performed and risks borne by different entities. It helps identify who benefits from what in a transaction and determines the appropriate compensation.

Is functional analysis required?

The requirements for including a functional analysis in transfer pricing documentation vary across different jurisdictions, but international guidelines provided by the OECD suggest that both a brief written functional analysis and a detailed comparability and functional analysis should be included. Most of local regulations also require having functional analysis. So the short answer is Yes.

What is functional interview?

A functional interview is a meeting with employees of an analysed company to clarify the

functions, assets, and risks of the business. Since there are at least two

companies involved in the transaction, it may be necessary to talk to

representatives of both.

It is worth recalling the main goal of functional analysis, which is the identification, analysis, and evaluation of economically significant functions executed by the parties of the transaction; the risks taken, and the assets used.

It is worth recalling the main goal of functional analysis, which is the identification, analysis, and evaluation of economically significant functions executed by the parties of the transaction; the risks taken, and the assets used.

It is sometimes the case that the entity is a pharmaceutical manufacturer, but the transaction under review is the provision of IT services to another group company (since the manufacturer also hosts an IT service centre). As the analysed transaction is IT services provision, we would focus on FARs that are relevant for this transaction and would be less interested in manufacturing FARs.

In terms of scope, a functional interview can still aim at identifying functions, assets, and risks of an entity as a whole, as information gathered can help to prepare functional analysis for several transactions at the same time.

The level of detail would also depend greatly on complexity, materiality, and tax risk associated with the transaction. For relatively small and less risky transactions, contracts and other background documentation may give a good picture of the transaction, and functional interview will simply aim at confirming the facts and conclusions of functional analysis. More complex and material transactions, though, may require dozens of functional interviews and discussions.

There are multiple internal guidelines developed by tax authorities, which describe functional interview process and recommendations. These guidelines are often publicly available and give valuable information about the tax authorities’ approach. We will further use them to study the best practices of functional interviews.

Why is

functional interview needed?

You sometimes

may hear that functional interviews are not necessary, as information about

functions, assets and risks can come from intercompany agreements, websites of companies,

annual reports, etc. However, the functional analysis should focus on the actual

conduct of the parties of the transaction. The information from documents usually

does not give a sufficient level of detail, nor it provides an insight into

actual conduct.

How should the functional interview be handled?

How should the functional interview be handled?

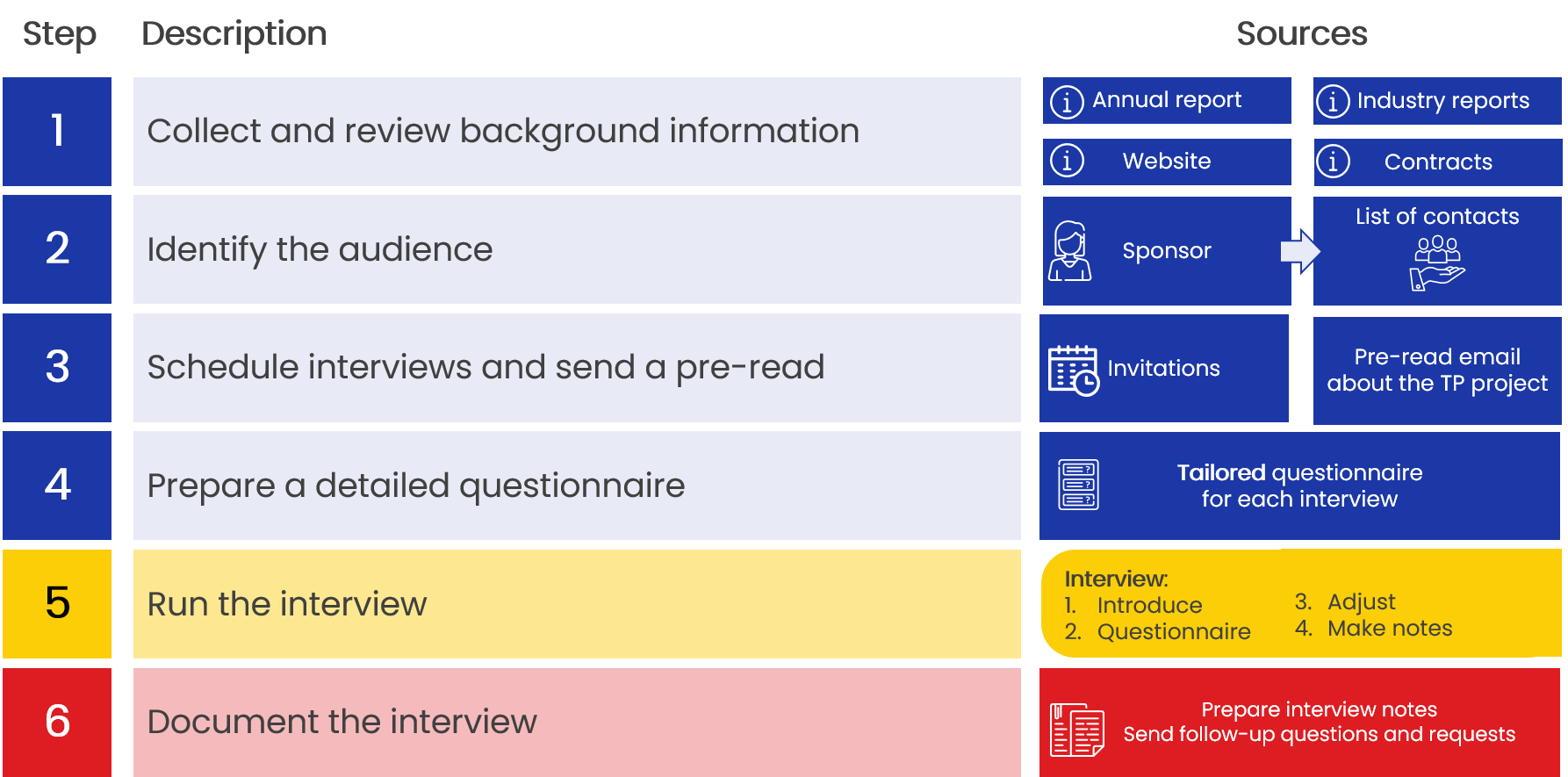

There are six

critical steps to a successful functional interview that are summarised in the

picture below. This is a general list, and you need to tailor your interview approach to the particular situation.

Here are a few

additional sources that may help you to prepare questionnaires (functional interview questions) for your

functional interviews, as well as follow-up questions and discussions:

- UN Practical Manual on Transfer Pricing for Developing Countries (2013 version), Appendix 1, Part 3 – Functional Analysis Checklist (p. 432-437)

- IRS Exhibit 4.61.3-4 (05-01-2006) accessible as Appendix 1 (p.105-112) of “A Toolkit for Addressing Difficulties in Accessing Comparables Data for Transfer Pricing Analyses”

For more details about key steps of functional interviews preparation, check our transfer pricing course (Module 4) or the textbook (Chapter 4).

What are your experiences with functional interviews? Share your hints and tips, and we will add them to the post!

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.