Transfer pricing of intra-group services: a toolkit for the analysis

Cross-border intra-group services transactions are especially

challenging to assess. Unlike tangible goods, services are not observable at a

country’s borders. For tax administrations, it may be challenging to measure

and evaluate these transactions, and they often see intra-group services as tax

avoidance instruments. Therefore, specific guidance is needed to assess intra-group

services from a transfer pricing perspective. That is why both the OECD

Guidelines and the UN Manual dedicate separate chapters for the discussion

about intra-group services.

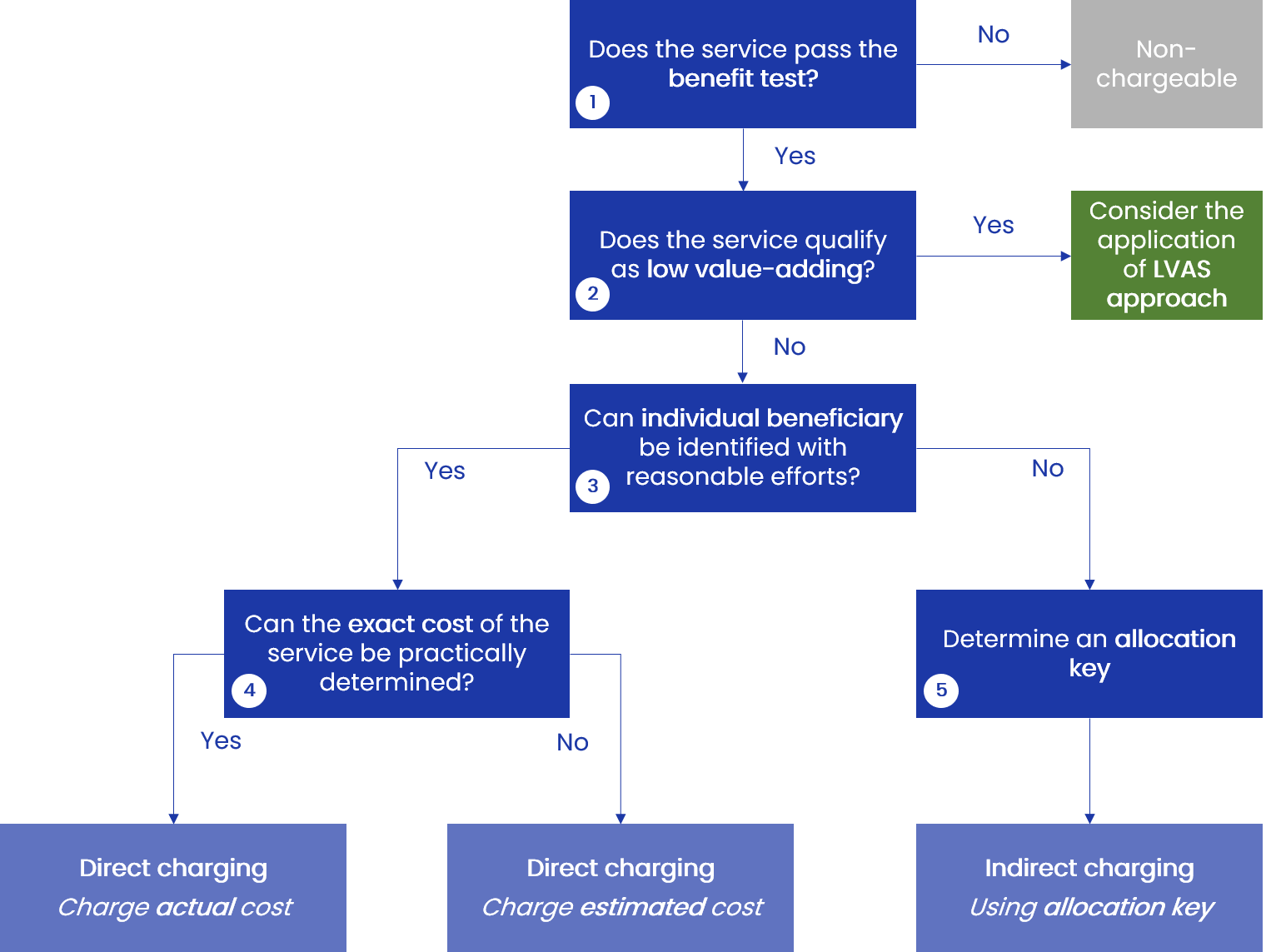

Below, we are summarizing key elements of transfer pricing analysis of intra-group services. You can remember and use a decision tree during the ADIT exam, as well as in your work.

1. Does the service pass the benefit test?

1) Demonstration that the recipient received the service, and

2) Demonstration that the recipient needed the service The OECD Guidelines specifically mention several cases where benefit test will not be passed, including shareholder activities, duplicate services and incidental benefits (including passive association).

1. What factors should be considered when deciding whether to charge for central services?

When determining whether to charge for central services, numerous factors should be taken into consideration. It is important to thoroughly evaluate each case individually. Some of the key factors that should be considered include:

1. Economic or Commercial Benefit: Central services should be charged for if they provide an economic or commercial advantage to the recipient. This means assessing whether the service will contribute positively to the departments or business units that utilize it.

2. Profitability: It is crucial to assess whether a profit should be made from providing the central service. This involves analyzing the costs associated with delivering the service and determining if the fees charged would cover these costs while still allowing for a reasonable profit margin.

3. VAT Consequences: The potential value-added tax (VAT) implications should also be taken into account. VAT is a consumption tax that is levied on goods and services at each stage of production and distribution. Understanding how charging for central services may affect VAT obligations and compliance is essential.

Additional factors that may be considered could include:

4. Cost Allocation: Evaluating how the costs of central services should be allocated among the departments or business units that benefit from them. This includes determining a fair and equitable method of distributing the costs to ensure transparency and avoid unfair burdening of specific units.

5. Market Analysis: Conducting a market analysis to understand if similar services are commonly charged for in the industry or sector. This can help benchmark the pricing to ensure it is competitive and in line with industry standards.

6. Internal Policies: Assessing any internal policies or guidelines that may already exist within the organization concerning charging for central services. These policies can provide a framework for decision-making and ensure consistency across different service offerings.

By carefully considering these factors, a comprehensive and well-informed decision can be made on whether or not to charge for central services, ensuring alignment with the organization's goals, financial sustainability, and fairness among recipients.

2. When should an appropriate mark-up be determined for the costs of central services?

An appropriate mark-up for the costs of central services should be determined based on the transfer pricing method used. It is crucial to analyze and allocate the costs of central services before evaluating the mark-up needed. The mark-up will vary depending on the specific service being provided. It is important to note that for third-party or pass-through costs, which involve expenses incurred on behalf of group members as an intermediary with no value addition, there should be no expectation of charging relevant beneficiaries at a mark-up.

To simplify the determination of mark-up for low value-added services, the OECD Guidelines suggest a safe harbour approach. Under this approach, a fixed mark-up of 5% can be added to the costs without the need for additional benchmarking analyses. This provides a straightforward and practical solution for applying mark-up to low value-added services, ensuring compliance with transfer pricing regulations.

3. How do you allocate costs for central services?

When allocating costs for central services, it is crucial to determine the breakdown of these costs into directly allocable and indirectly allocable categories. Directly allocable costs are those that can be easily attributed to a specific legal entity, department, or business unit. On the other hand, indirectly allocable costs cannot be directly linked to a particular legal entity, department, or business unit, and therefore require the use of allocation keys for distribution.

Allocation keys serve as methods to distribute indirectly allocable costs to the parties benefiting from the central services. Several types of allocation keys can be employed, depending on the nature of the costs and the organization's structure. Some common allocation keys include the number of employees, the amount of time spent utilizing the services, the square footage occupied by each party, or even the revenue generated by each entity.

By utilizing appropriate allocation keys, organizations can ensure a fair and accurate distribution of costs for central services among the relevant parties. This approach allows for transparency and accountability, as each entity is assigned its share of the costs based on their level of benefit from the central services provided.

4. How do you determine the cost of a central service?

Determining the cost of a central service involves a comprehensive process that can be broken down into several steps.

Firstly, it is important to establish if a service has actually been rendered. This means that the service provided must have commercial or economic value and benefit the recipient. To determine this, it is necessary to evaluate whether the recipient would be willing to pay an independent party to perform the same activity or be prepared to bear the cost of performing the activity in-house.

Once it has been established that a service has indeed been rendered, the next step involves calculating the cost of the service. This entails identifying and considering all direct and indirect costs associated with providing the service. These costs can include salaries, benefits, supplies, and equipment among others. It is important to exclude any non-chargeable services from the calculation.

After determining the overall cost of the service, it is necessary to further break it down into directly allocable and indirectly allocable costs. Directly allocable costs are those that can be directly attributed to a specific legal entity, department, or business unit. On the other hand, indirectly allocable costs are those that cannot be directly attributed and thus require allocation keys or methods to assign them appropriately.

Once the costs have been identified for allocation, it may be necessary to determine an appropriate mark-up depending on the transfer pricing method used. The mark-up is typically a percentage added to the cost and varies based on the nature of the service being provided.

In conclusion, determining the cost of a central service involves evaluating if a service has been rendered, calculating the cost by considering all direct and indirect costs, breaking down the cost into directly and indirectly allocable costs, and potentially applying an appropriate mark-up based on the transfer pricing method used.

4. What is the benefit test for determining whether to charge out a central service?

The benefit test is an essential criterion used to determine whether a central service should be charged out. It involves ascertaining whether the service provided offers commercial or economic value and if it benefits the recipient. In other words, the service must have tangible advantages that can be identified and measured.

To pass the benefit test, it is necessary to consider whether the recipient would willingly pay an independent party to carry out the same activity. This implies that the service should be of sufficient quality and value that the recipient would be willing to engage an outside entity and compensate them accordingly. Additionally, the recipient should also be ready to assume the costs associated with performing the service in-house, if necessary.

By applying the benefit test, the decision-maker can objectively evaluate the viability of charging out a central service. It ensures that the service not only has inherent value but also positively impacts the organization in terms of economic or commercial benefits.

If you want to know more about services transactions, transfer

pricing methods that are applied in the analysis and see examples of intra-group

services - sign up for a free module of our transfer pricing course!

Contact us: study@startaxed.com

Featured links

Get your free TP cheat sheet!