Permitted Texts Review

Borys Ulanenko

Students often ask about permitted texts. In this post, we will look at materials that are allowed on the ADIT Transfer Pricing exam, which of them are useful, and where to get them.

What are the permitted texts?

When sitting the ADIT exams, candidates are allowed to bring some books and materials into the exam room. This is extremely helpful, as these texts are useful when answering questions and solving problems.

Can I print these texts and take self-printed copies?

Generally, the CIOT does not allow self-printed

copies, and they strongly encourage candidates to take only original, bound

copies to the exam. However, in some instances (where candidates cannot access

original copies), CIOT allows taking self-printed copies of permitted books or

text – but remember that they require individual, written dispensation from the

CIOT. If you decide to try taking self-printed copies with you, remember that you must receive

permission from CIOT no

later than 48 hours before your exam. For further details, refer to the CIOT guidance on permitted texts.

Can I make notes, underline, highlight text in the copy that I am bringing into the exam room?

The CIOT website is

clear on what is allowed, and what is not. You may:

• Underline words and sentences.

• Highlight

words and sentences, or sideline pages (highlight edges of the pages when

the book is closed).

• Tag pages

with small index flags.

• Fold pages.

You

may not annotate your books in any way (your name and candidate number are

fine). You are also not allowed to bring note paper (including any sticky notes

in the book), post-it notes or any other handwritten notes.

Overview of permitted texts

For 3.03 Transfer Pricing session, the following books and materials are permitted:

OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations

The OECD Guidelines is a 600-page book that explains how the arm's length principle should be applied by MNEs and tax authorities, as well as providing an overview and recommendations on administrative practices and transfer pricing documentation. The current version is from 2017, though there are some reports that were finalised after 2017, which will soon be implemented in the OECD Guidelines (i.e., the Financial Transactions Guidance).

The OECD Guidelines is a cornerstone document for the current transfer pricing regime. It contains answers to most of the ADIT questions; therefore, being able to navigate quickly through its content is a critical skill for the successful passing of this exam.

Should I take the OECD Guidelines to the exam?

Absolutely! The OECD Guidelines is must-have. If you take only one book with you, take this one.

Where to get it?

You can buy it from the OECD official page, or, i.e. from Amazon. It is not cheap, though – the current price is around 120 euro. It makes sense to check with your colleagues or your employer – perhaps, your corporate library has this book already, and you can borrow it for the exam.

Should I take the OECD Guidelines to the exam?

Absolutely! The OECD Guidelines is must-have. If you take only one book with you, take this one.

Where to get it?

You can buy it from the OECD official page, or, i.e. from Amazon. It is not cheap, though – the current price is around 120 euro. It makes sense to check with your colleagues or your employer – perhaps, your corporate library has this book already, and you can borrow it for the exam.

OECD Model Tax Convention on Income and on Capital (and accompanying Commentary)

One of the most important documents developed by the OECD is a Model Tax

Convention, which serves as a "template" when two countries want to

enter into a bilateral double tax treaty. The text of the OECD Model Tax

Convention comprises 32 articles. The convention itself is quite short (about 25

pages). However, the commentaries that explain the provisions of the convention

and assist in its application and interpretation are very extensive (around 700

pages in the condensed version).

Should I take the OECD MTC to the exam?

It is strongly recommended. Many exam syllabus items are closely connected with the OECD Model Tax Convention, and commentary may help to answer some questions (i.e. on PEs, double taxation issue, etc.).

Where to get it?

Similar to the OECD Guidelines, you can buy it from the OECD official page, or i.e. from Amazon. The original copy is sold for about 100 euro. It is a very popular material, so check with your peers and colleagues.

Should I take the OECD MTC to the exam?

It is strongly recommended. Many exam syllabus items are closely connected with the OECD Model Tax Convention, and commentary may help to answer some questions (i.e. on PEs, double taxation issue, etc.).

Where to get it?

Similar to the OECD Guidelines, you can buy it from the OECD official page, or i.e. from Amazon. The original copy is sold for about 100 euro. It is a very popular material, so check with your peers and colleagues.

OECD Report on the Attribution of Profits to Permanent Establishments (2010)

This is a 241-pages OECD document that explains how the profits should be

attributed to permanent establishments. It gives useful guidance on the

application of the Authorised OECD Approach and the application of the arm's

length principle to PE situations.

Should I take it to the exam?

It is good to have, but not a must. Even though the ADIT exam

syllabus includes PEs, there is a low chance you will be asked to apply a very

detailed PE profit attribution analysis. The Report will not give you any

significant benefits if you know how the Authorised OECD Approach works in

general, and you are able to articulate the main steps of the analysis.

Where to get it?

You can try buying it from the OECD official page or from Turpin

Distribution, however, as of October 2020, the publication was out of stock.

Therefore, you can request CIOT to allow you to take the self-printed copy of

this material!

OECD/G20 Base Erosion and Profit Shifting Project 2015

Final Reports (Actions 8-10, 13)

These reports are the outcome of the BEPS

project, and they were largely included in the 2017 version of the OECD

Guidelines.

Should I take them to the exam?

It is good to have, but not a must. Even though the text of the

OECD Guidelines was updated and aligned with the BEPS final reports in 2017,

there are still some additional useful sections (that were not transferred to

the Guidelines). For example, if there will be a specific question on the

outcomes of the BEPS project for some transfer pricing issue, you may use BEPS

final reports instead of the full OECD Guidelines text.

Where to get them?

Similar to the PE report, you can try

buying it from the OECD official page or from Turpin Distribution, however, as

of October 2020, the publication was out of stock. Therefore, you can request

CIOT to allow you to take the self-printed copy of this material.

UN Practical Manual on Transfer Pricing for Developing Countries (2017)

The UN Manual is largely in line with the OECD Guidelines and actually builds on it. It provides a novel and needs-based approach to explain what the OECD Guidelines mean for developing countries, and how they can be applied in practice in a way that responds to their priorities and realities. In many instances, the UN Manual repeats the OECD Guidelines, but it often provides additional examples and step-by-step instructions on the application of the arm's length principle. There are some elements of the UN Manual that are unique (and are not reflected in the OECD Guidelines), i.e. guidance on the "sixth method", country-specific examples, etc.

Should I take it to the exam?

It is good to have, but not a must. There is a low chance that you will have enough time to consult with both the OECD Guidelines and the UN Manual. If you know both sources very well, and you prefer the UN Manual in some of the questions, of course, you may find it very useful. However, in practice, you would probably have to use the OECD Guidelines only.

Where to get it?

It is good to have, but not a must. There is a low chance that you will have enough time to consult with both the OECD Guidelines and the UN Manual. If you know both sources very well, and you prefer the UN Manual in some of the questions, of course, you may find it very useful. However, in practice, you would probably have to use the OECD Guidelines only.

Where to get it?

You can buy it from the UN official bookshop, or from any other book vendor like Amazon

or Book Depository. It has quite a reasonable price of 65 USD.

& the UN Model Double Taxation

Convention between Developed and Developing Countries (2017)

The UN Model is very similar to the OECD Model when it

comes to transfer pricing related issues. There are some important differences when it comes to

PEs, for example, but the chance of specific question about the UN Model is

rather low.

Universal solution - Van Raad's Materials on International, TP and EU Tax Law. Volume A

Van Raad's Materials is my favourite option when it comes to the ADIT

permitted texts. This book combines the OECD Model and Commentary, the OECD

Guidelines, the Report on the Attribution of Profits to Permanent

Establishments, and many other useful texts. This book is just the combination,

under one cover, of all important texts.

Should I take them to the exam?

We strongly recommend buying the Van Raad's Materials if you don't have the OECD Guidelines, the OECD Model Tax Convention, or the Report on the attribution of profits to PEs.

Where to get it?

You can buy it directly from Wildy & Sons bookstore. This is also a very cost-effective solution, as you get many permitted texts in one book for 85 pounds only.

Should I take them to the exam?

We strongly recommend buying the Van Raad's Materials if you don't have the OECD Guidelines, the OECD Model Tax Convention, or the Report on the attribution of profits to PEs.

Where to get it?

You can buy it directly from Wildy & Sons bookstore. This is also a very cost-effective solution, as you get many permitted texts in one book for 85 pounds only.

Summary - the strategy

Our recommendation is to get Van Raad's Materials. When it comes to the BEPS reports and other permitted texts that are not included in Van Raad's Materials, you can check with CIOT, and perhaps you will be allowed to take a self-printed copy.

We are studying the permitted texts in our transfer pricing course, and provide links and references so that you know them well and can use them during the exam.

Sign-up for a free demo of our course to see references, and download a free chapter of our textbook to understand the approach to permitted texts. Contact us: study@startaxed.com

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

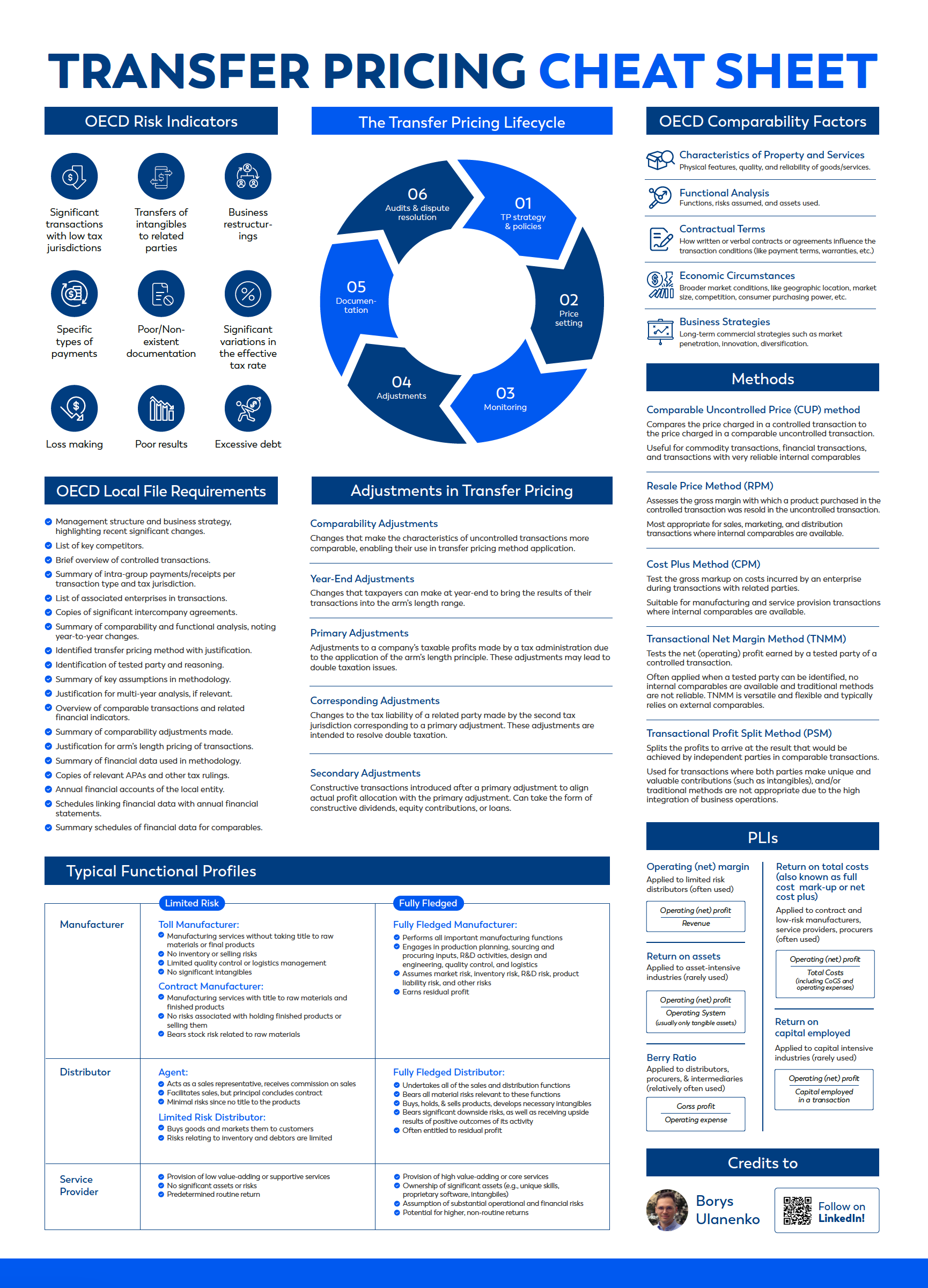

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.