Safe Harbours in Transfer Pricing

Borys Ulanenko

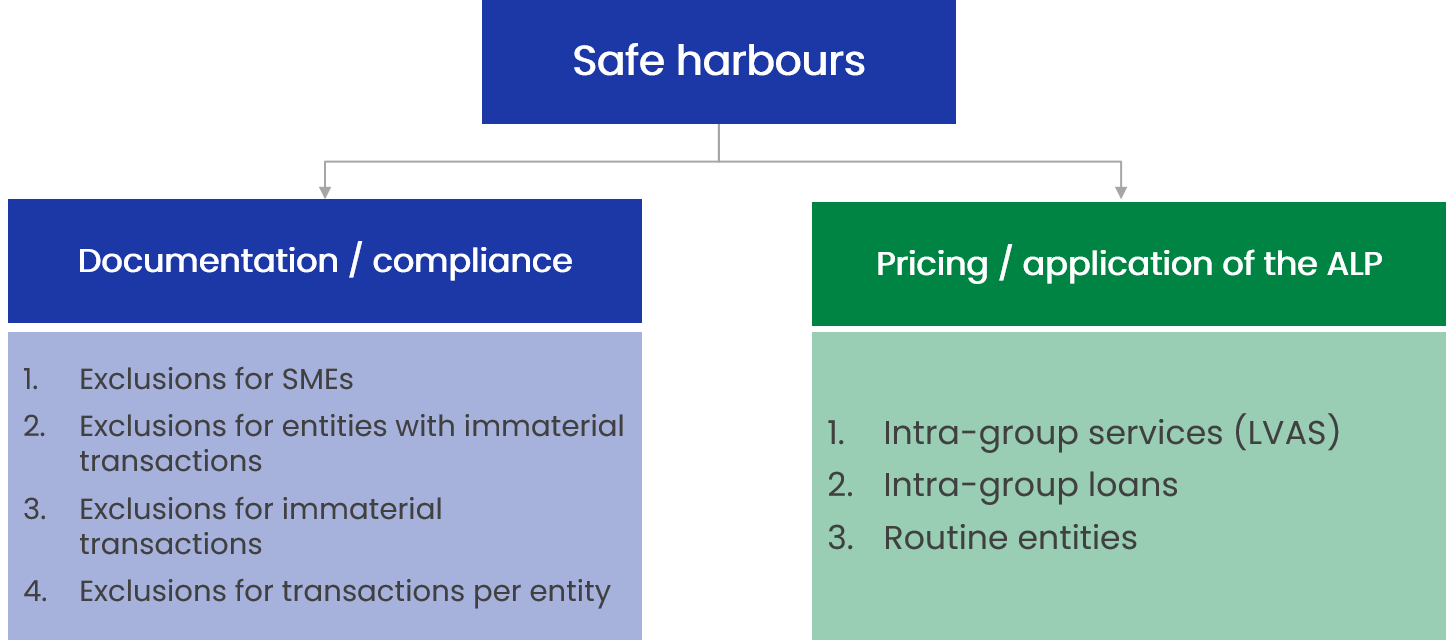

OECD Guidelines define a safe harbour as "a provision that applies to a defined category of taxpayers or transactions and that relieves eligible taxpayers from certain obligations otherwise imposed by a country's general transfer pricing rules.". In the transfer pricing world, there are two common types of safe harbours utilised by countries:

- Simplified documentation requirements for small companies and/or immaterial transactions – for example, if the revenue of the company is below a certain threshold, there is no obligation to prepare transfer pricing documentation. The transfer pricing documentation and specific requirements are discussed in Module 16 of our transfer pricing course.

- Prescribed pricing, margins and mark-ups for particular types of transactions. For example, the most widely used safe harbour of this type is a provision for low value-adding services that allow the use of cost plus 5% methodology for a certain kind of services (without the need to prepare a benchmarking study). We cover low-value adding services in Module 10 of our transfer pricing course, and you can sign up for a free demo that includes low-value adding guidance discussion. Also, relatively wide-spread type of safe harbour is the safe harbour interest rate on intra-group loans.

In the past, the OECD explicitly urged against the use of safe

harbours. However, the 2017 version of the OECD Guidelines changed the tone,

and the OECD now recognises that in some circumstances (specifically, small taxpayers

and/or less complex transactions), the use of safe harbours can be justified.

There are a number of benefits of safe harbours:

- They provide compliance relief. For example, in the case of low-value adding services, there is no need to prepare a benchmarking study, and 5% can be used as an arm's length mark-up.

- They provide certainty to both the taxpayer and tax administration. Companies do not have a risk that their mark-up or margin will be challenged, as well as tax authorities being able to guarantee a certain level of taxable profit. Note, however, that there is still potential for dispute, as tax authorities may, for example, disagree with the classification of specific services as "low-value adding".

- They permit tax administrations to allocate their resources better and focus on high-risk taxpayers and transactions.

Some countries go beyond standard low-value adding services and

provide more transactions where safe harbours can be used. For example, in Australia, certain taxpayers can use the following safe harbors:

| Category/transaction | Safe harbour |

| Distributors | EBT ratio ≥3% (operating margin) |

| Low value-adding intragroup services | 5% mark-up |

| Technical services | 10% mark-up |

| Low-level inbound loans | 3.76% (2019 example) |

Usually, the use of safe harbours is optional for the taxpayer, e.g., if they prefer to set up pricing for the transaction based on the full benchmarking study, this is allowed. Before setting up the pricing and/or preparing the documentation, though, it is advisable to check local safe harbour provisions, analyse eligibility, and make a conscious decision about the use of such rules.

Even though

the use of safe harbours generally benefits taxpayers, certain risks should be

considered. The most prominent issue is that safe harbours are often

unilateral, i.e. provided by one country, while another country (where the

counterparty is located) may apply general arm's length principle to the

transaction that falls under the safe harbour.

Therefore, even though a safe

harbour can give certainty in one country, tax authorities of another country

may require testing the transaction using standard guidance (and do the

benchmarking study, for example).

If you want to know more about safe harbours

and related issues, register for our transfer pricing course – we discuss this

topic in Module 18.

Contact us: study@startaxed.com

Contact us: study@startaxed.com

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

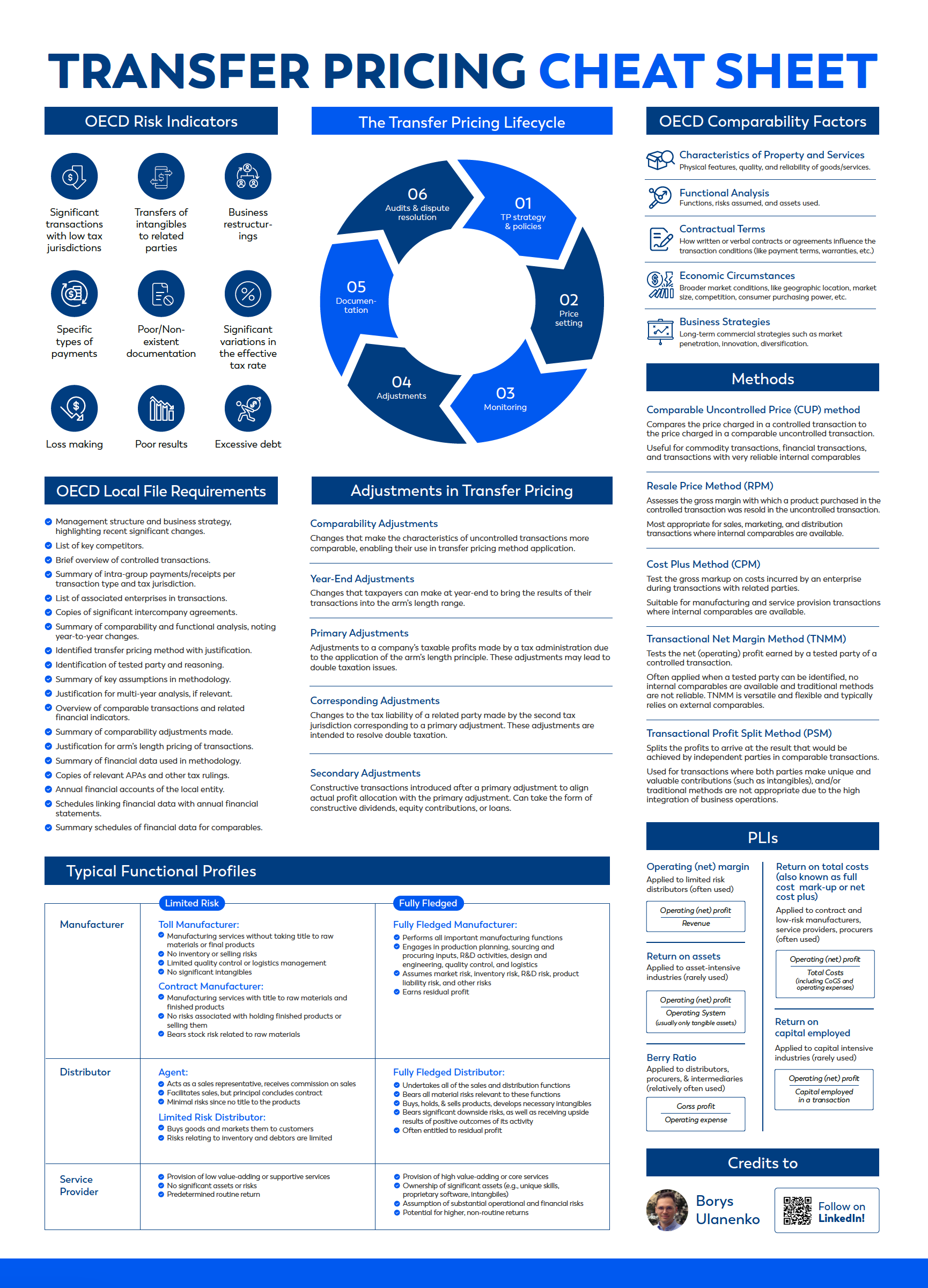

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.