What is TNMM and CPM, or 4 Mistakes Tax Professionals Make When Applying TNMM

Nov 10

/

Borys Ulanenko

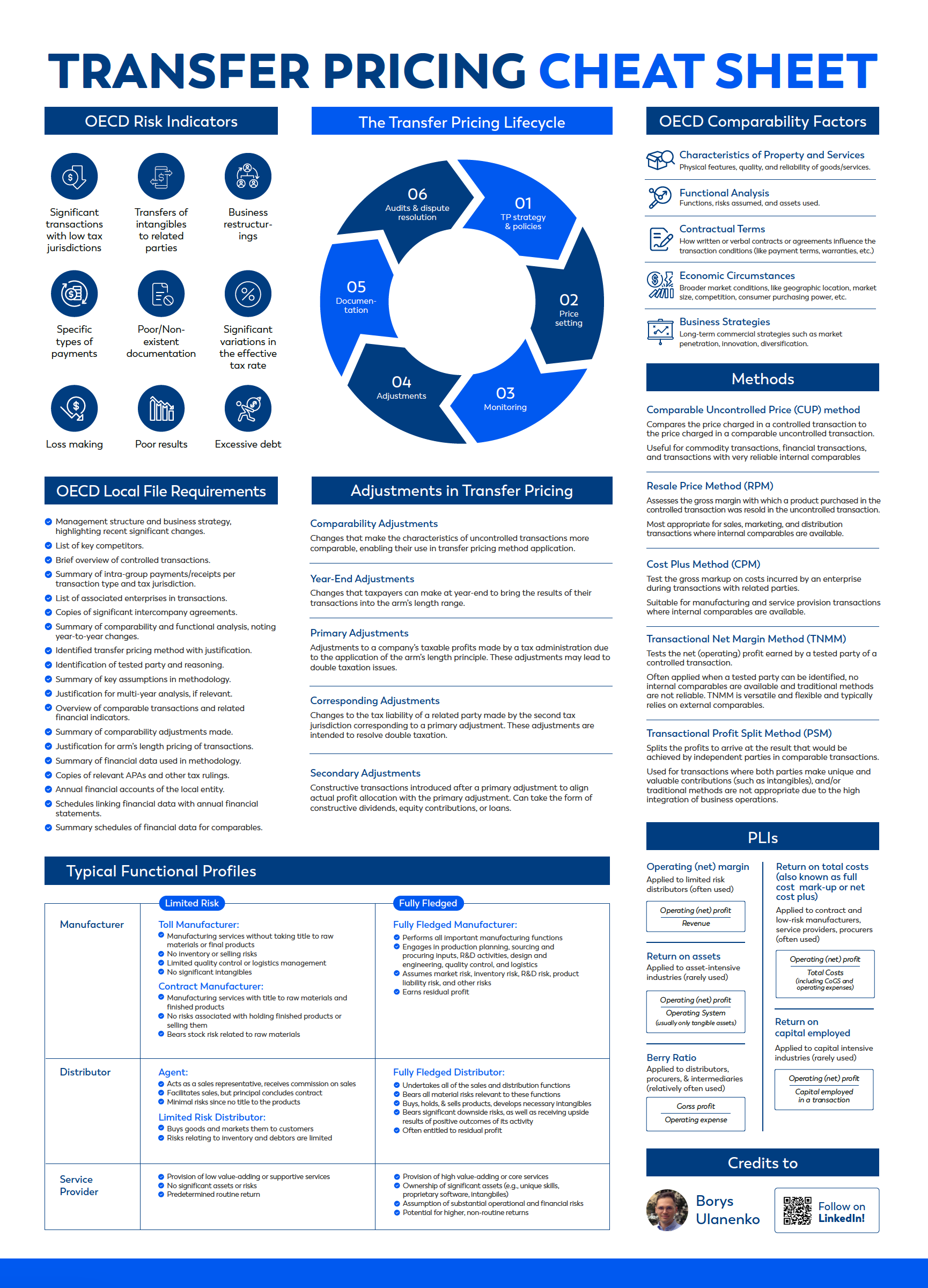

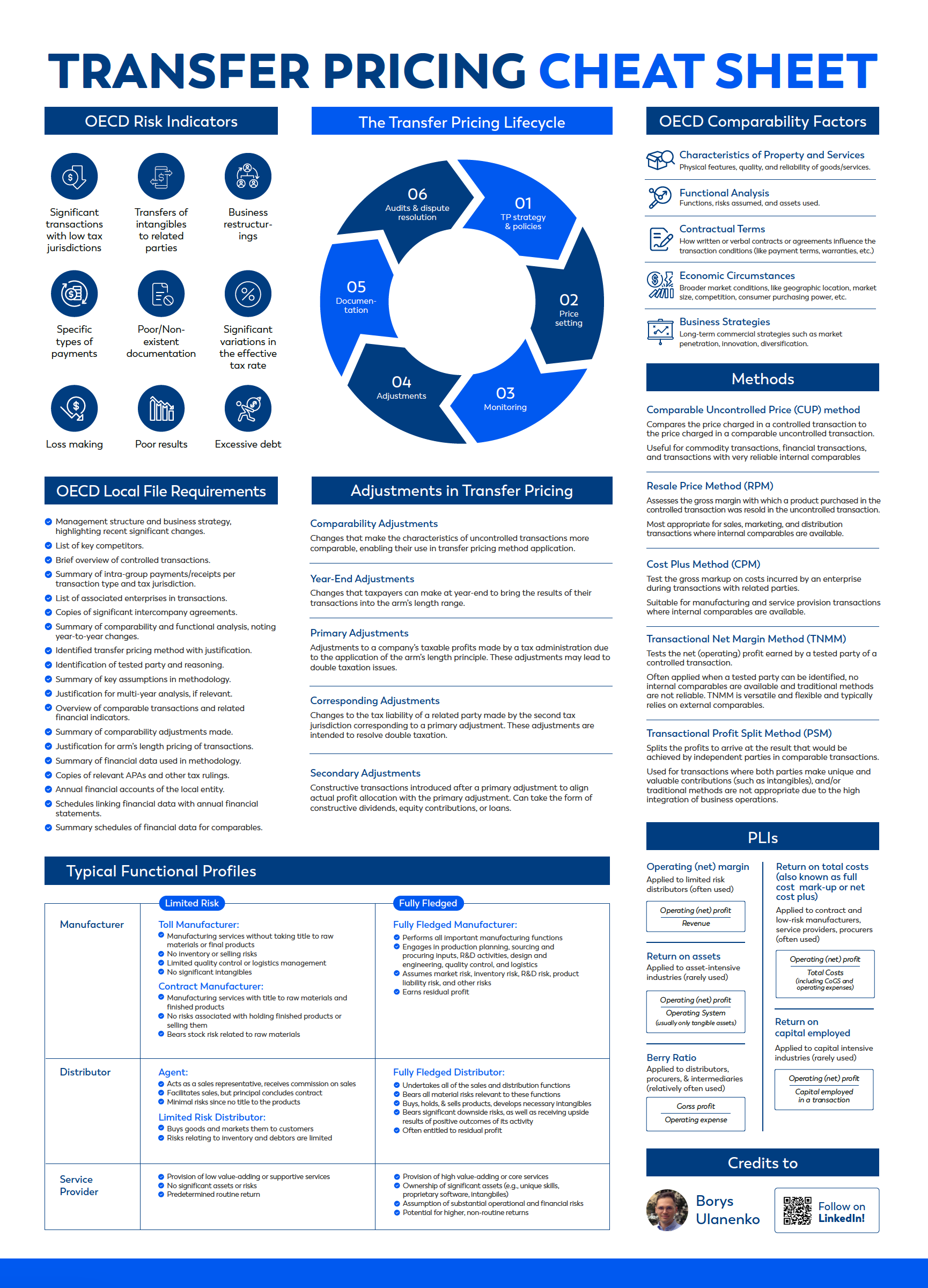

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Quick Reference: Key Transfer Pricing Principles Summarized

Have all core TP concepts at your FINGERTIPS

Get your free TP cheat sheet!

Thank you! Download here.

Transactional Net Margin Method (TNMM) is a transactional profit method that compares the net profit earned by a tested party of a controlled transaction with the net profit earned in uncontrolled transactions. TNMM relies on the principle that functionally similar companies operating in a similar market tend to make similar returns (measured through a profit level indicator) over time.

TNMM has a

twin-brother method in the US transfer pricing regulations, called the comparable profits method

(CPM). If you are working within the US or supporting US companies with

transfer pricing, you should be aware that the comparable profits method is, in

essence, TNMM under a different name (differences are rather theoretical).

In the last

decade, TNMM became almost a default transfer pricing method for many

taxpayers. The TNMM/CPM was used for 86% of transactions in APAs that IRS faced

in 2018, while all other methods combined accounted for the other 14% only.

This makes understanding TNMM critically important for every tax and transfer

pricing specialist.

TNMM is very similar to the resale price method and the cost plus method, as it assesses the profits of one of the parties of the transaction (one-sided profit method) and allocates residual profits to the other party. The main difference, however, is that TNMM compares net/operating profit indicator, while RPM and CPM look at gross profit margin/mark-up. This leads to several significant differences between these methods:

• Operating profits are less affected by variations in accounting policies. For instance, some costs like insurance, transportation, or warranty expenses may be reflected as CoGS or operating costs. This potential difference in treatment affects gross profit and gross margin, but operating profits are not affected.

• Operating profits are less affected by functional differences. Some functions or risks may have a significant impact on gross margins, while operating margins are smoother.

• Information about gross profits of potentially comparable companies is less widely available compared with operating profits.

• TNMM is used at a high aggregation level, assessing a series of transactions or even results of the entity as a whole, while traditional transactional methods lean towards testing separate transactions.

This makes TNMM easier to apply in cases where there is no significant intangible property involved.

TNMM is very similar to the resale price method and the cost plus method, as it assesses the profits of one of the parties of the transaction (one-sided profit method) and allocates residual profits to the other party. The main difference, however, is that TNMM compares net/operating profit indicator, while RPM and CPM look at gross profit margin/mark-up. This leads to several significant differences between these methods:

• Operating profits are less affected by variations in accounting policies. For instance, some costs like insurance, transportation, or warranty expenses may be reflected as CoGS or operating costs. This potential difference in treatment affects gross profit and gross margin, but operating profits are not affected.

• Operating profits are less affected by functional differences. Some functions or risks may have a significant impact on gross margins, while operating margins are smoother.

• Information about gross profits of potentially comparable companies is less widely available compared with operating profits.

• TNMM is used at a high aggregation level, assessing a series of transactions or even results of the entity as a whole, while traditional transactional methods lean towards testing separate transactions.

This makes TNMM easier to apply in cases where there is no significant intangible property involved.

In practice,

we observe the following issues when TNMM is applied:

1) Overuse - TNMM is often seen as a default method;

therefore, other methods are ignored (even though they may provide more

reliable results). For example, it is not rare for a taxpayer to “forget” about

existing internal comparables and jump straight to TNMM, even though these

internal comparables may allow the reliable application of traditional methods. Another case is where significant intangible assets are ignored.

2) Oversimplification – transfer pricing advisors can

sometimes use template studies with generic analysis. For example, the crucial step

in the TNMM application is the selection of the tested party (that is based on

findings of functional analysis and actual business activity of the company), and you need to ensure that your functional

analysis is detailed and takes into account both contractual terms and actual

conduct. It is not rare for tax authorities to challenge the tested party

selection, which can question all transfer pricing methodology.

3) Incorrect margin/mark-up analysis – even though TNMM allows a certain

level of aggregation, it does not mean you can take a total P&L of the tested

party and calculate the profit indicator from there. Segmentation of the

P&L is a crucial step of TNMM analysis, and you must ensure it is done

properly.

4) Generic benchmarking studies – TNMM application is almost always

based on external comparables (uncontrolled taxpayers), and therefore having proper benchmarking study

is a key. It is not rare for advisors to prepare standard generic benchmarking

studies that are not tailored to the facts and circumstances of a particular transaction and use the same interquartile range in every case.

Tax authorities, in contrast, become more aware of the benchmarking technologies

and approaches, and they start challenging taxpayers’ benchmarking studies more

and more often. In other words, there is a disconnect between standards of comparability.

And remember that in cases where significant intangible assets are involved, it makes sense to closely assess the use of the profit split method instead of TNMM!

And remember that in cases where significant intangible assets are involved, it makes sense to closely assess the use of the profit split method instead of TNMM!

What are other issues with the TNMM method that you observe in practice? Let us know, and we will add them to the list!

In our textbook, we dedicate three detailed chapters for the discussion of the transactional methods and comparability analysis, including 10 practical examples and cases that explain the application of TNMM and benchmarking studies. We also extensively discuss the TNMM in our transfer pricing course.

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.