This Is How a Local File of the Future May Look Like

What is local file? How TP documentation framework looks like now?

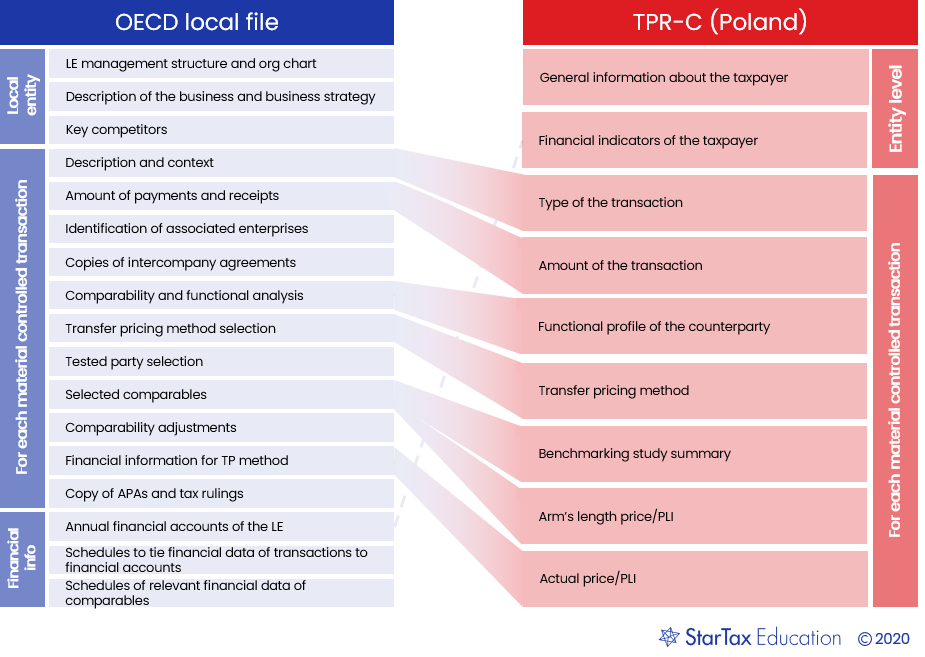

Under the BEPS project, OECD undertook a review of transfer pricing documentation standard and introduced a universal approach to a local file, master file, and Country-by-Country report. Since 2015, the majority of the countries updated their local file requirements to meet the OECD standard (or introduced new requirements where they did not exist). We discuss the BEPS Action 13 and transfer pricing documentation in Module 16 of our course.

One country decided to revolutionize the TP requirements

Due to the weaknesses of the OECD local file standard, Poland decided to expand its transfer pricing compliance rules. Starting from the year 2020, Polish taxpayers will be obliged to prepare and submit the TPR-C form. The form is a hybrid reporting standard that combines the data traditionally reported in the local file with information usually disclosed in TP forms. Here is a list of information that must be included in TPR-C:

- General

information about the taxpayer – standard for all tax forms.

- Financial indicators of the taxpayer – companies have to calculate and provide actual

operating margin, net cost plus, return on assets and return on capital. This information

can immediately be used to identify companies with financial results that

significantly deviate from market trends.

- Transactional information (per transaction), including:

· Type of the transaction (purchase/sale of goods/services, financial transactions, IP transactions, etc.)

· Functional profile of the counterparty (limited risk / full risk entity)

· Amount of the transaction

· Transfer pricing method applied to the transaction

· Depending on the method and type of the transaction, you may have to:

· Indicate the minimum and maximum price of the item transferred, as well as minimum and maximum arm's length price (for the CUP method)

· Indicate the profit level indicator (for profit-based methods), the tested party, actual value of the PLI, information about the benchmarking study you are using (including the geography of comparables and the arm's length range)

· For financial transactions, you need to indicate the debt amount, interest amount, interest rate, references to the floating indicators (like LIBOR), the margin applied on top of the floating rate, etc.

Immediate consequences of the TPR-C

- Material

- Conducted with low-tax jurisdictions

- Have suspicious financial results (e.g. tested party is a limited risk company that has negative result)

For more details about the textbook and the course, contact us:

Featured links

Get your free TP cheat sheet!