UK Transfer Pricing Documentation: Things You Should Know

Borys Ulanenko

HMRC has just announced that from April 2023, large businesses will have to maintain a Transfer Pricing Master File and local file, as well as a supporting summary audit trail. We thought it was time to summarise the main things you need to know.

The UK presently lacks prescriptive transfer pricing documentation rules, however, documentation that conforms to the latest OECD guidance is increasingly being recommended.

Change #1: Master file and local file

The government will introduce a requirement on multinational groups to keep, and make available on request, master file and local file documentation, in line with the OECD standard. The requirement will apply to groups subject to country-by-country reporting requirements, e.g., multinationals with an annual turnover of EUR 750 million or more. Unless there is a material UK tax risk, HMRC will not require the inclusion of intra-UK transactions in the TP documentation.

There would be no mandatory filing obligation for transfer pricing documentation, but the taxpayer would be expected to provide the documentation within 30 days of a request by HMRC (including the summary audit trail explained below).

Change #2: Summary audit trail

The Revenue is planning to introduce a new requirement for producing a summary audit trail that would accompany the transfer pricing documentation. The summary audit trail would be a short, concise document summarizing the work already undertaken by the business in arriving at the conclusions presented in the TP doc.

The summary audit trail would encourage taxpayers to implement transfer pricing policies properly. It would also enable HMRC to focus on higher-risk areas during their investigations and prevent wasting resources in low-risk cases.

NOT a change yet #3: International Dealings Schedule

It was initially proposed to introduce the International Dealings Schedule (IDS), a TP return or form we discussed in this post.

HMRC has decided not to implement the International Dealings Schedule (IDS) for now. The use of such detailed schedules by other countries has proven to be costly for businesses, and the benefits to tax authorities have not been clearly articulated. Nevertheless, HMRC still believes that the IDS could benefit both businesses and HMRC, and it will keep the issue under consideration for possible implementation in the future.

Summary

Although the UK would now have transfer pricing documentation requirements, the scope is quite narrow and includes only large companies. This is very different from other countries, where this requirement applies to most businesses and transactions. Before the new transfer pricing documentation rules are implemented, MNEs will have ample time to prepare (nevertheless, they should start preparing now).

We discuss the TP documentation requirements in Module 16 of our course.

We discuss the TP documentation requirements in Module 16 of our course.

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

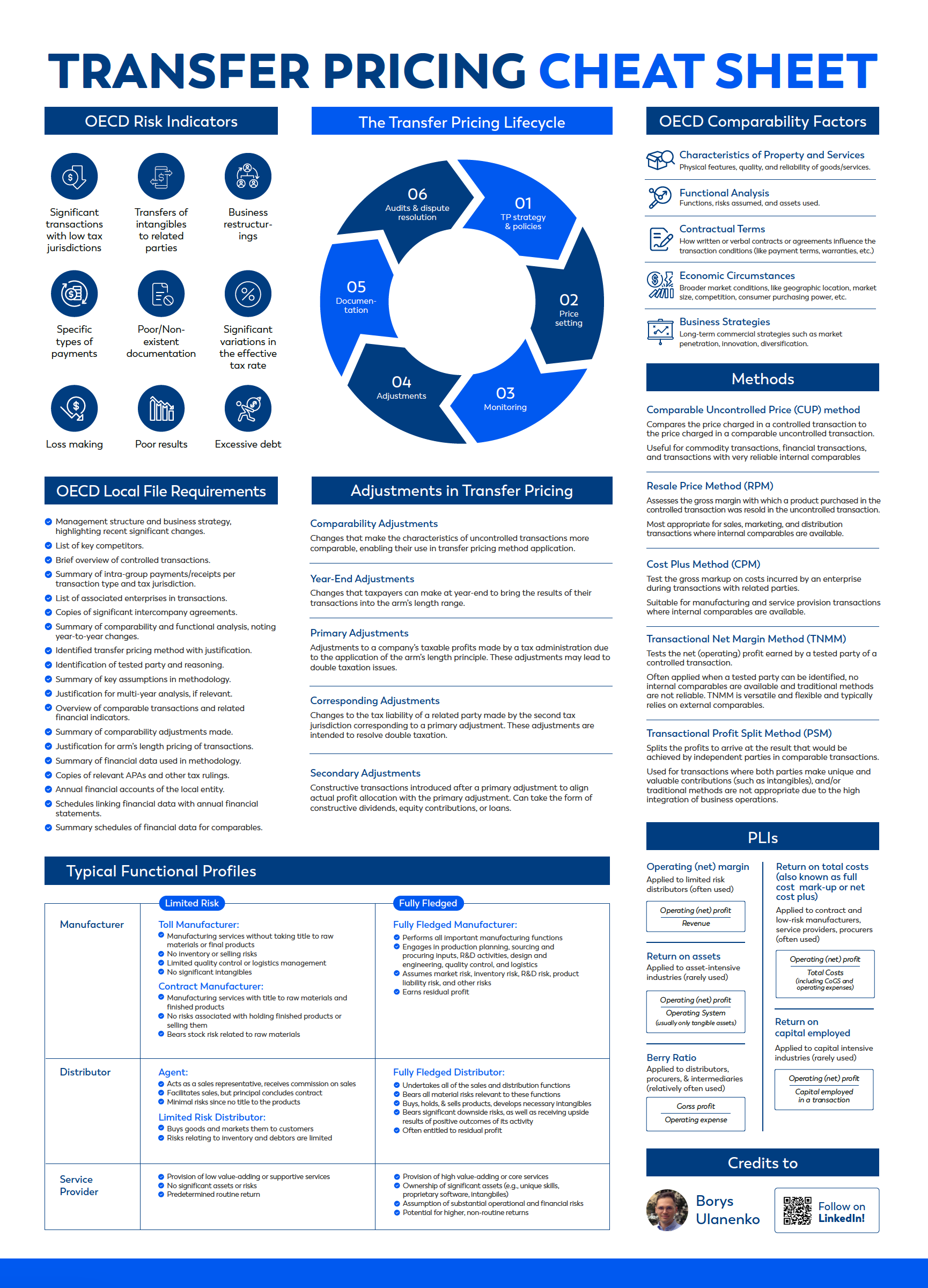

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.