EU Public CbCR - Is It Too Late?

Borys Ulanenko

What has happened?

The European Union implements public country-by-country reporting (CbCR) for multinational enterprises. This means that companies will be required to reveal their profits, taxes, and other figures on a country by country basis.

When the EU first proposed the public CbCR initiative in 2016, it was supposed to come into effect by 2017. However, the initiative was in deadlock until early 2021 because of opposition from the Member States over the cost of implementation and privacy concerns. Many countries were also concerned that they would lose any tax revenues if companies moved their assets offshore to avoid reporting.

In 2021, though, the EU moved quickly to implement public CbCR. There were two main reasons for that - first, the change of balance of power within the EU towards the Member States driving the transparency agenda. Second, radical transparency advocates and conservatives finally reached a compromise. As with many other EU law changes, this reporting requirement is implemented through the EU Directive. Click here to access the actual public CbCR Directive.

This is a significant change for multinationals. Until now, most multinationals have avoided any public tax reporting - there has been no requirement for them to disclose details on where their profits are made.

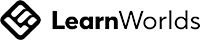

Is EU public CbCR the same as BEPS Action 13 CbCR?

Not really - EU public CbCR would be more limited in scope. In particular, EU public CbCR would not require disclosure of revenues split per third/related parties, tangible assets and stated capital. Also, EU public CbCR would only require to report numbers per EU member countries and "black"/"grey" listed countries, while numbers for the rest of the world would be aggregated. EU public CbCR will apply to MNEs with EU headquarters and multinationals headquartered outside the EU if they have significant operations in the Member States.

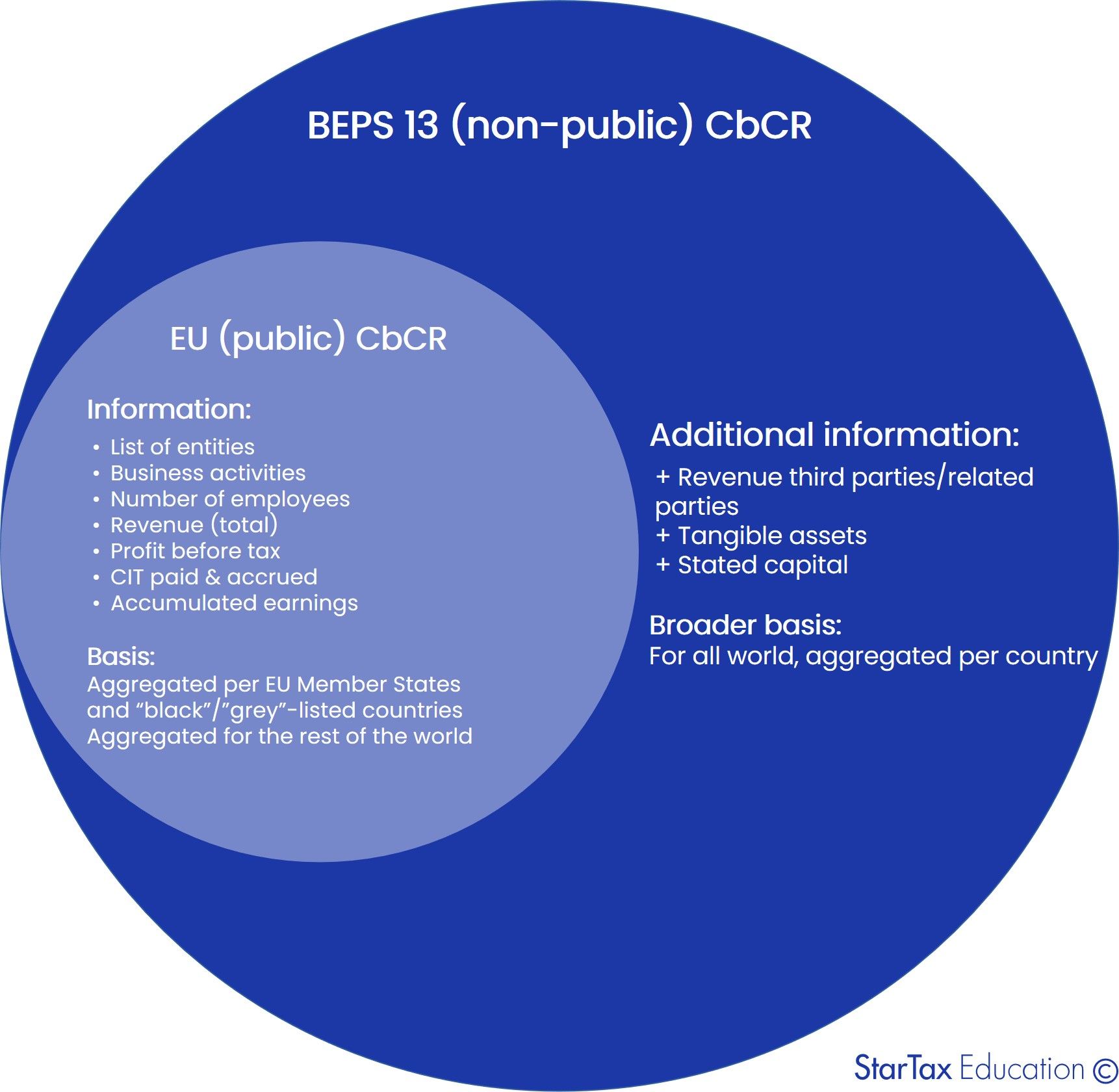

What's the implementation timeline?

Here are the key dates:

November 11, 2021 - the European Parliament adopted the text

December 1, 2021 - the text was published in the Official Journal of the EU

December 21, 2021 - Directive enters into force (20 days since publication)

June 22, 2023 - deadline for the EU Member States to transpose the Directive into national law

June 22, 2024 - rules apply for the first financial year starting on or after this date

2025 - the first reportable year (for calendar year taxpayers)

End of 2026 - the first reporting deadline.

We've also summarized the main dates in the infographics below.

November 11, 2021 - the European Parliament adopted the text

December 1, 2021 - the text was published in the Official Journal of the EU

December 21, 2021 - Directive enters into force (20 days since publication)

June 22, 2023 - deadline for the EU Member States to transpose the Directive into national law

June 22, 2024 - rules apply for the first financial year starting on or after this date

2025 - the first reportable year (for calendar year taxpayers)

End of 2026 - the first reporting deadline.

We've also summarized the main dates in the infographics below.

As you can see, the EU is very generous in giving the EU Member States a lot of time to transpose the Directive into national law. Also, taxpayers would have plenty of time to prepare for the first reporting deadline.

What's wrong with the EU public CbCR initiative?

There are a few issues that the EU was unable to address:

1) As we mentioned above, the Directive is a product of a compromise: some Member States tried to keep reporting requirements limited. As a result, companies that have the most operations in the EU are the most affected and would have to provide more detailed information. In contrast, MNEs that have most of their operations outside the EU would be able to aggregate the data and "hide" most of their grey areas.

2) Implementation timeline is very long - the first CbCRs will be published only in 2026. With the accelerating growth of the digital economy, we are not sure the information presented there would give a good picture of MNEs operations. Another question is if CbCR, as we know it now, is a good instrument in the modern world, and what would happen to the public CbCR initiative if OECD decides to review the CbCR overall.

3) The Directive is not too precise and may lead to "interpretive problems" when Member states start implementing it.

The main problem for MNEs, though, is that they need to prepare for public scrutiny once their numbers become public.

1) As we mentioned above, the Directive is a product of a compromise: some Member States tried to keep reporting requirements limited. As a result, companies that have the most operations in the EU are the most affected and would have to provide more detailed information. In contrast, MNEs that have most of their operations outside the EU would be able to aggregate the data and "hide" most of their grey areas.

2) Implementation timeline is very long - the first CbCRs will be published only in 2026. With the accelerating growth of the digital economy, we are not sure the information presented there would give a good picture of MNEs operations. Another question is if CbCR, as we know it now, is a good instrument in the modern world, and what would happen to the public CbCR initiative if OECD decides to review the CbCR overall.

3) The Directive is not too precise and may lead to "interpretive problems" when Member states start implementing it.

The main problem for MNEs, though, is that they need to prepare for public scrutiny once their numbers become public.

We were discussing the Tax Transparency in our blog here. Also, check out Module 16 of our course for more details about CbCR.

For more details about the textbook and the course, contact us:

We are an online educational platform that helps professionals and aspiring individuals to succeed in their goals.

Featured links

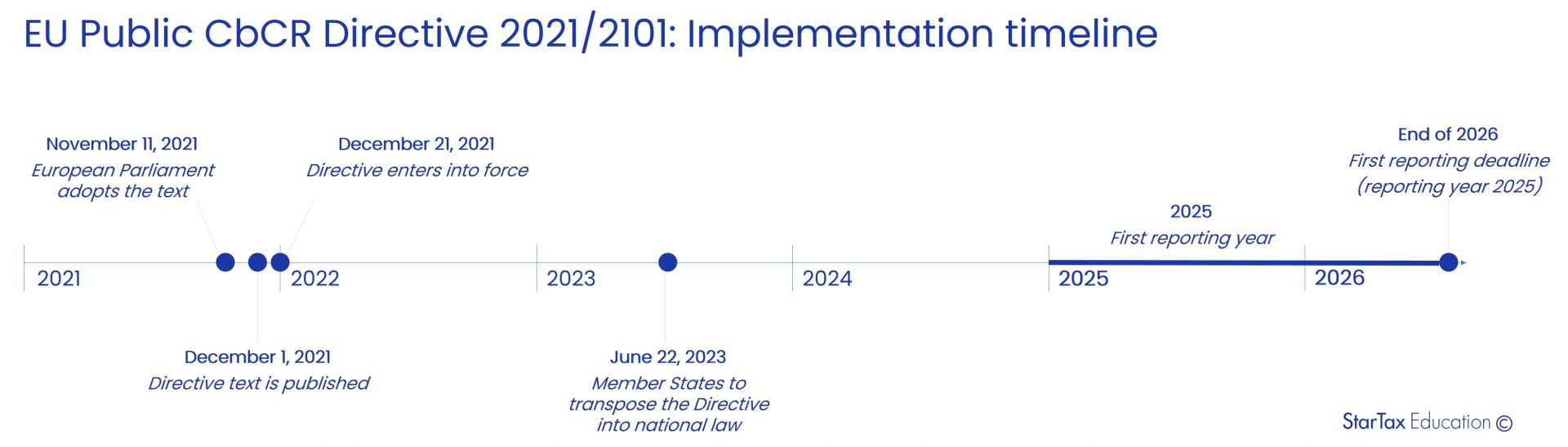

Get your free TP cheat sheet!

Discover the essential concepts of TP in one concise, easy-to-follow cheat sheet.

Thank you! Download here.

What is the EU Directive?

The EU is run by an elected EU Parliament and an appointed European Council. The European Parliament approves EU law, which is implemented through EU Directives drafted by the Commission. National governments are then responsible for implementing the Directive into their national laws. In other words, EU Directives are draft laws that then get passed by national governments and then implemented by institutions within the member states.

What is CbCR?

Country-by-Country Reporting (CbCR) is part of mandatory tax reporting for large multinationals. MNEs with combined revenue of 750 million euros (or more) have to provide an annual return called the CbC report, which breaks down key elements of the financial statements by jurisdiction. A CbC report provides local tax authorities visibility to revenue, income, tax paid and accrued, employment, capital, retained earnings, tangible assets and activities. CbCR was implemented in 2016 globally.